My morning reads:

• Blood in the Streets: Countries and their CAPE values (World Beta)

• Sell Mortimer, Sell! Obama Victory Leads Wealthy to Make Quick Pre-2013 Moves (Bloomberg)

• Banking’s ‘Worst Nightmare’ Takes Her Fight to Senate (WSJ) see also The Importance of Elizabeth Warren (Economix)

• The second worst trade of 2012? Wall Street’s terrible presidential bet (Quartz)

• Fidelity Says 401(k) Balances Reached Highest Level (Bloomberg)

• Rest in Peace: ‘Uncertainty’ (CNN Money)

• Asian Voters Send a Message to Republicans (Bloomberg) see also As Nation and Parties Change, Republicans Are at an Electoral College Disadvantage (Five Thirty Eight)

• Battle Plan Shifts on Dodd-Frank (WSJ)

• Krugman: Let’s Not Make a Deal (NYT) see also How Other Animals Choose Their Leaders (Slate)

• How the GOP’s War on Voting Backfired (The Nation)

What are you reading?

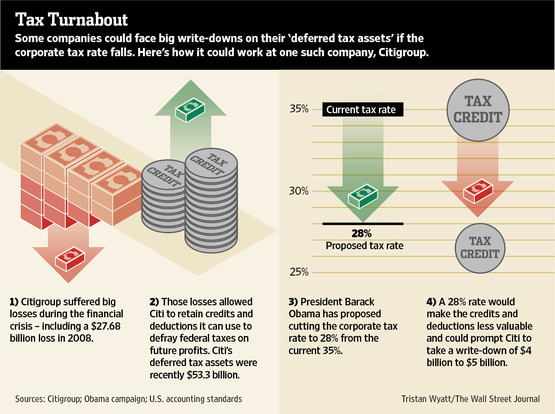

Corporate Tax Twist

Source: WSJ

What's been said:

Discussions found on the web: