My afternoon train reads:

• Meaning of 200-day average’s violation (MarketWatch)

• Deep Truths about the Markets and Investing (Crossing Wall Street)

• Art Cashin: Late-Day Fades Are Troubling (MarketBeat)

• 10 things 401(k) plans won’t tell you (MarketWatch) see also Retirement Plan Shift Is Creating a Generation of Workers Unable to Retire (Yahoo Finance)

• Treasuries See U.S. Falling Over Cliff as Yields Converge (Bloomberg)

• Big data will be big business in India (Quartz)

• Housing Agency Close to Exhausting Reserves (WSJ)

• Are Your Political Beliefs Hardwired? (Smithsonian)

• A More Impressive Win Than in 2008 (The Atlantic) see also Bankers Abandoned Obama — But the Rest of the Rich Held Surprisingly Strong (The New Republic)

• Brilliant! The greatest Up Yours, Media response ever: David Petraeus Affair Photos

What are you reading?

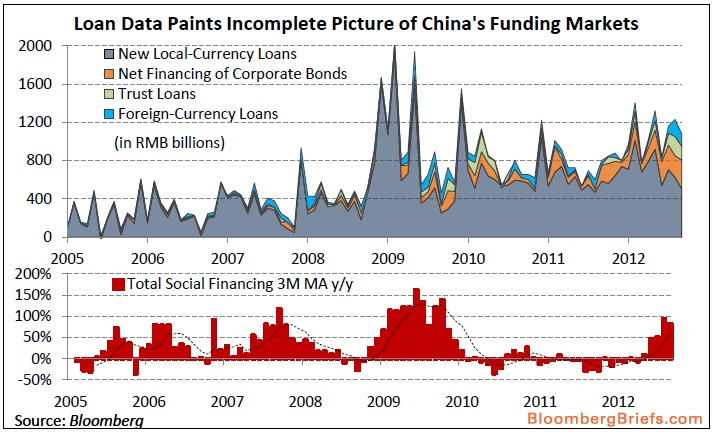

Decline in China’s Traditional Loans More Than Offset by Surge in Social Financing

Source: Bloomberg Brief

What's been said:

Discussions found on the web: