My afternoon train reads:

• Reports of economy’s death are premature (MarketWatch) but see Pimco: Stocks dead, bonds deader till 2022 (MarketWatch)

• Mobile Market Share Not Equivalent to Usage Share (TenFingerCrunch)

• The 401(k) Is a $240 Billion Waste (The Atlantic) see also Most Savers Are Passive, Little Influenced by Tax Breaks (WSJ)

• The fiscal cliff is a lie (Salon)

• Reversing the Brain Drain (FT Alphaville)

• China’s ubiquitous ghost cities (FT Alphaville) see also In China, Hidden Risk of ‘Shadow Finance’ (WSJ)

• How PRWeb Helps Distribute Crap Into Google & News Sites (Search Engine Land)

• The statisticians at Fox News use classic and novel graphical techniques to lead with data (Simply Statistics)

• Behind Seth Green’s stop-motion animation success (CNNMoney)

• Hilarious new tumblr! Floor Charts (Senate Charts)

What are you reading?

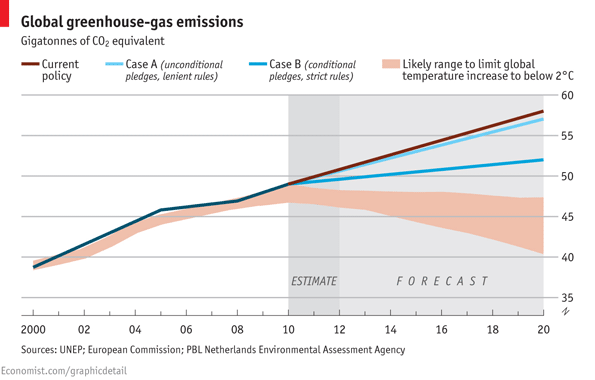

Hot and bothered

Source: The Economist

What's been said:

Discussions found on the web: