Source: IBD

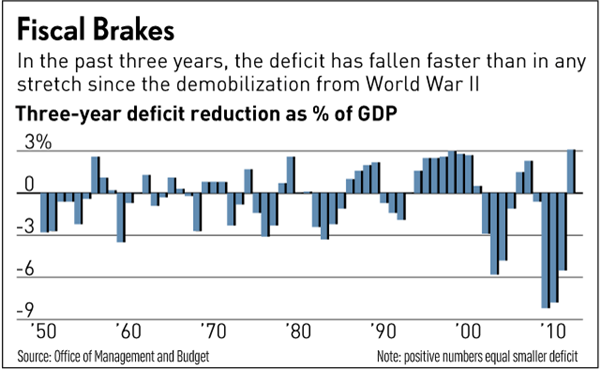

Wow, this is a rather surprising data point: “From fiscal 2009 to fiscal 2012, the deficit shrank 3.1 percentage points, from 10.1% to 7.0% of GDP.”

It is even more surprising when you consider its source is the usually conservative Investors’ Business Daily.

Here is a longer excerpt:

Believe it or not, the federal deficit has fallen faster over the past three years than it has in any such stretch since demobilization from World War II.

In fact, outside of that post-WWII era, the only time the deficit has fallen faster was when the economy relapsed in 1937, turning the Great Depression into a decade-long affair.

If U.S. history offers any guide, we are already testing the speed limits of a fiscal consolidation that doesn’t risk backfiring. That’s why the best way to address the fiscal cliff likely is to postpone it.

Yet more proof that the fiscal cliff is a manufactured crisis of minimal importance.

Source:

U.S. Deficit Shrinking At Fastest Pace Since WWII, Before Fiscal Cliff

JED GRAHAM

Investors Business Daily, 11/20/2012

http://news.investors.com/blogs-capital-hill/112012-634082-federal-deficit-falling-fastest-since-world-war-ii.htm

What's been said:

Discussions found on the web: