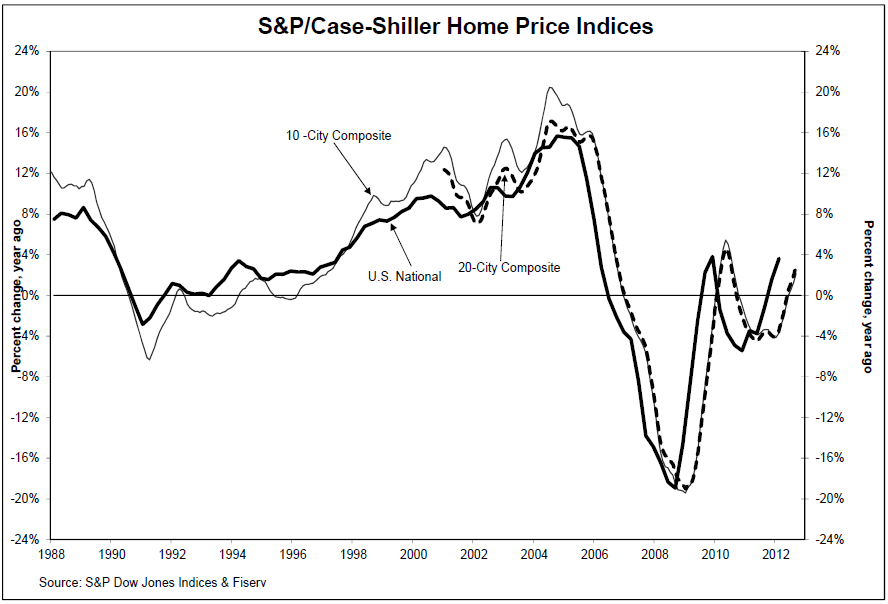

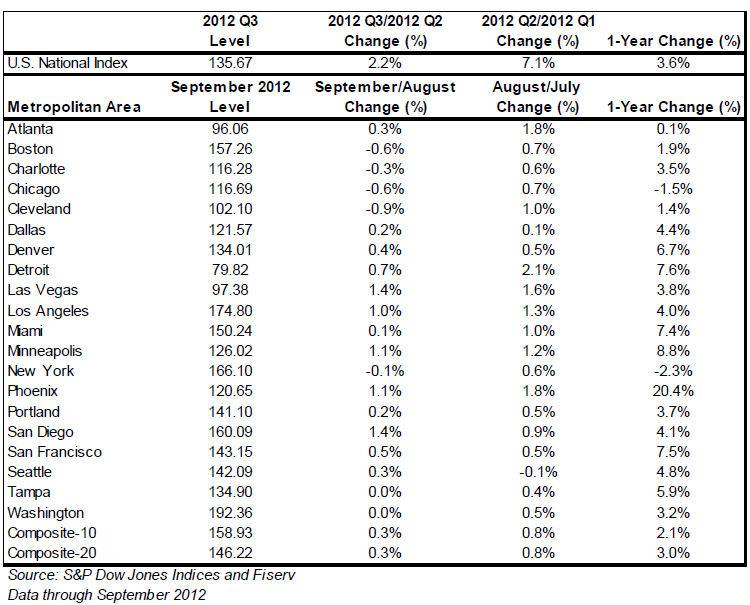

Home prices, according to the S&P/Case Shiller report, rose 0.4% sequentially (seasonally adjusted) in September and 3% year over year.

The index is now up for an 6th straight month, putting it at the highest level since Oct ’10 while still remaining 31% below its ’06 highs.

Jonathan Miller notes the declining momentum in Home sales: Falling mortgage rates are not creating housing sales. He blames credit remaining very tight. On a year over year basis, 18 of the 20 cities surveyed saw gains. Only Chicago and New York saw declines. Miller observes that year-over-year comparisons in various national reports are “skewed higher from an anemic 2011.” Housing Pulse confirms this, observing further that 1st-time home buyers are not seeing any gains from the so-called recovery.

The bottom line is that housing has stabilized — but done so in a rate driven artificial manner — at least for now.

More Case Shiller Charts after the jump

Source:

Home Prices Rise for the Sixth Straight Month According to the S&P/Case-Shiller Home Price Indices

Dave Guarino and David Blitzer

S&P Dow 500, November 27, 2012

What's been said:

Discussions found on the web: