Over the weekend, I set the Closer Look at Mythology graphic to post early this morning.

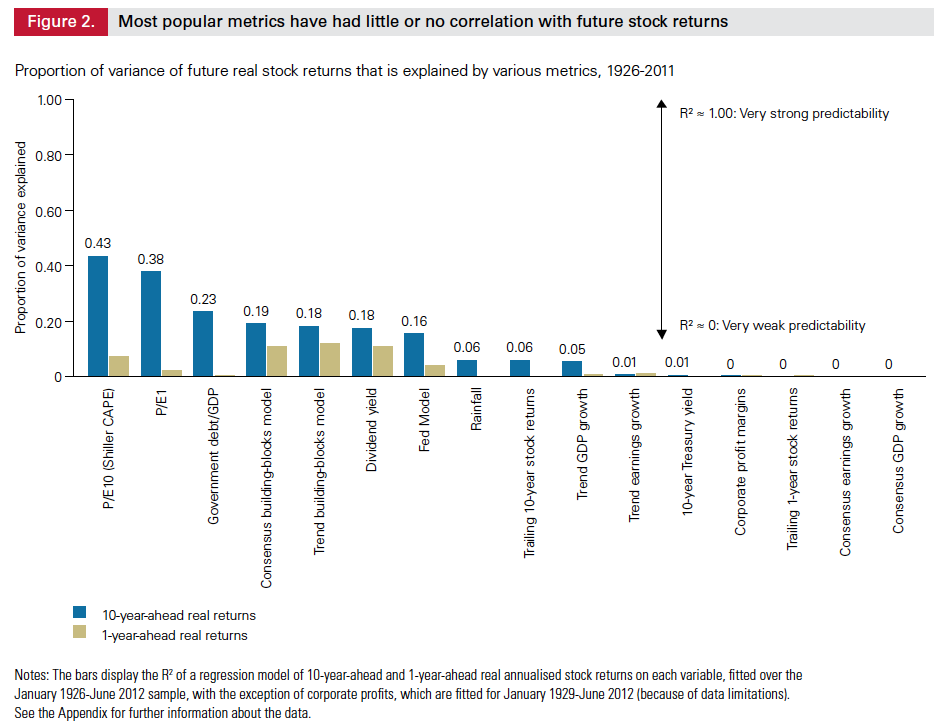

By sheer coincidence, Meb Faber pointed us to the above chart from Vanguard looking at the correlation between traditional valuation metrics and subsequent investment returns. Given the serendipity of how similar the messages were in both, I thought it was worth exploring further.

What I find worth especially discussing is the simple observation that so many of the traditional metrics — the assumed truths of Wall Street — fail to withstand close scrutiny as having forecasting value. These include such varied metrics dividend yields, economic growth, Fed Model, profit margins, and past stock returns.

A few simple criticisms of the Vanguard piece are in order; yes, they are talking their book — forecasting is folly, asset allocation into broad indices is the best bet for investors — but that does not undercut their analysis. Perhaps a more significant complaint is a peeve of mine about single variable analysis — that looking at any one metric alone to explain complex systems (such as investment outcomes) is doomed from the start.

Regardless, this paper is worth reading. Keep it in mind the next time you see someone trotted out on TV to claim that stocks are a great/terrible buy RIGHT NOW because of any single one variable . . .

Previously:

Single vs. Multiple Variable Analysis in Market Forecasts (May 4th, 2005)

Source:

Forecasting stock returns: What signals matter, and what do they say now?

Vanguard research October 2012

http://bit.ly/TYNuda

What's been said:

Discussions found on the web: