Treasuries’ Foreign Buying Doubles China’s $123 Billion Cut

Source: Treasury data, Bloomberg

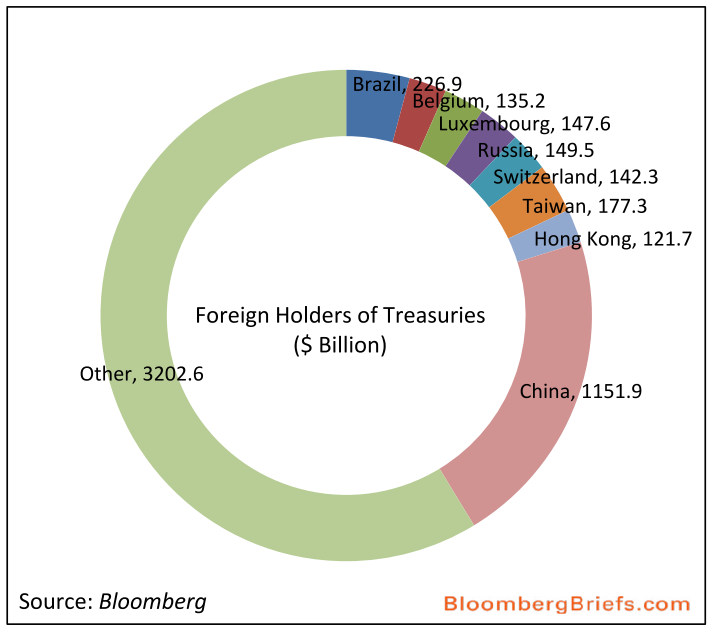

Bloomberg Briefs notes that “Belgium, Luxembourg, Russia, Switzerland, Brazil, Taiwan and Hong Kong boosted their holdings of U.S. government securities by a collective $264.8 billion since the last debt ceiling debate ended in August 2011.”

These purchases “more than made up for the decline in Treasuries owned by China,” down $123 billion to $1.156 trillion.

One note about the chart above — I don’t see Japan, who is a huge holder as well of US treasuries.

Source:

Treasuries’ Foreign Buying Doubles China’s $123 Billion Cut

Daniel Kruger & Niraj Shah

Bloomberg Briefs, November 19, 2012

What's been said:

Discussions found on the web: