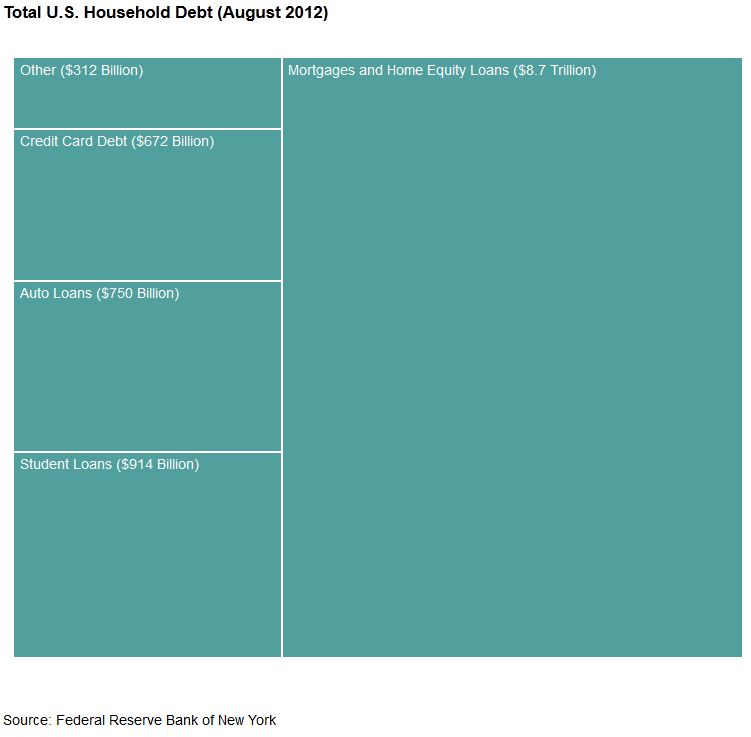

I like this chart of U.S. Household Debt — we now owe a bit less than at the peak of the bubble: $11.4 trillion, with Mortgage/home-equity debt still the biggest amount of that debt (by far).

Source:

Household Debt In America, In 3 Graphs

Lam Thuy Vo and Jacob Goldstein

NPR, November 26, 2012

http://www.npr.org/blogs/money/2012/11/21/165657931/household-debt-in-america-in-3-graphs

What's been said:

Discussions found on the web: