Since the market began its retrenchment a month ago, we have seen rallies on weak volume and selloffs on stronger volume. Historically, these are the characteristics of Dead Cat Bounces and softer rallies destined to fail.

But over the past few years, we have also seen markets rally on expectations of each and every new Fed intervention. QE4 was trial ballooned on Wednesday afternoon by the WSJ’s Jon Hilsenrath (Fed Stimulus Likely in 2013).

History teaches us that whenever the Fed wants to do a new intervention, they let the Street know by telegraphing their intentions this way. They thinking seems to be, “Don’t say we didn’t warn you.” James Bianco, with tongue firmly planted in cheek, has called Jon “The actual Federal Reserve Chairman.” In reality, Jon took over the slot formerly owned by Greg Ip (now at The Economist) as the Fed’s favored conduit to Wall Street.

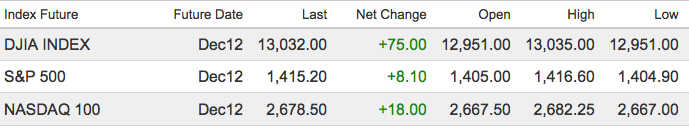

Despite the earnings weakness, dividend and capital tax avoidance trades, anemic volume and general complacency, yesterday saw a strong intra-day reversal in US equities. Markets shifted from down half a percent to up half a percent. Some of my technical friends will call this a triple-outside day — opening below the low of the past three days, and closing above the high of the past three days.

What this means is that short term, the 0fficial kick off of the Santa Claus rally is here. Traders can game this for a run up to the September highs.

Investors have a trickier challenge: This likely ends badly, but the QE4 announcement by acting FOMC chair Hilsenrath suggests just not yet. I want to see how markets trade today, but I suspect that there is an upside play for this rally into years end, perhaps even into Q1. Things get much trickier beyond that.

Let’s be careful out there . . .

What's been said:

Discussions found on the web: