The Financial Times – Bond markets: A false sense of security

Investors seek perceived refuge in bonds but fears are rising that their faith has been ill-placed

The demons afflicting market sentiment could be described as the “three FCs”. Tormented by the financial crisis, flash crashes and the impending fiscal cliff, investors have turned to the time-honoured refuge of bonds. But savers who have stocked up on bonds with record low yields face danger on two fronts: on the one hand, their income could be eroded by inflation, while on the other, the value of their holdings could fall sharply when interest rates do start to rise.

Comment

Whenever we see stories warning of the risks in bonds, as if the subject has never been discussed, we want to remind everyone that this is the only thing that has been said about the bond market for many years. And, it has been wrong for many years. Here is what we wrote last month:

Larry Fink hates bonds. Warren Buffett hates bonds. Guggenheim Partners hates bonds. Jeremy Siegel has hated bonds since the early years of the Clinton administration (1994). Nassim Taleb thinks every human on the planet should be short bonds. Leon Cooperman wouldn’t be caught dead owning bonds. Michael Steinhardt and Dan Fuss have also bad mouthed bonds. BofA says the 30 year old bull market in bonds is over.

These predictions all range from several months to several years old. 10-year yields have not cooperated with these sages as rates continue to stay low. Why? Maybe because these predictions are solidly a consensus opinion and consensus opinions rarely play out exactly as expected.

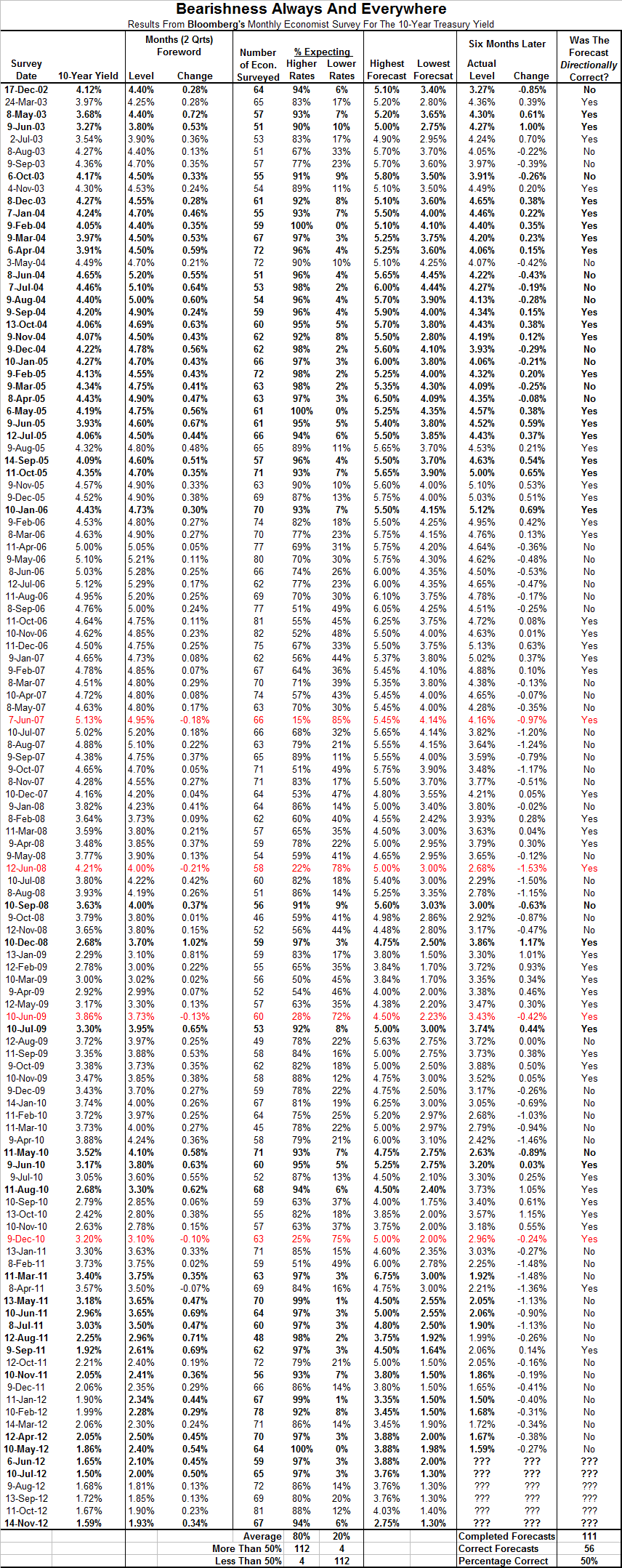

The table below shows the monthly survey of economists as conducted by Bloomberg. In the history of finance we cannot find a more one-sided opinion about a freely traded double-auction market. Witness:

• 116 months of surveys have been completed since December 2002.

• 112 of 116 (97%) of these surveys predict higher yields.

• 37 of 116 (32%) show more than 80% of economists predicted higher yields, including the last survey (November 2012).

• On three different occasions, 100% of economists predicted higher rates. The last occurrence was May 2012 when the 10-year yield was predicted to reach 2.40% over the next 6 months. This means the the 10-year yield has to rise 60 basis points this week to make this unanimous opinion correct. Don’t hold your breath.

• On the flip side, only four 4 of 116 (3%) surveys predicted lower rates, shown in red below. The last occurrence was December 2010 when 10-year yields were 150 basis points higher at 3.20%. The 10-year fell from 3.20% in January 2011 to 1.37% earlier this year without any of the surveys during the period predicting bullishness.

The world has been very bearish on bonds for years and has been very wrong. It is hard to make a case for value in the bond market when the Federal Reserve is pushing rates lower via QE. That said, this bearishness is so well understood that it has been priced into the bond market for a while now (years). We would argue this is why the constant drum-beat of bond bearishness has not been working as the bears have already placed their bets.

At some point the bond bears are going to be right. But after a decade of crying wolf, it is hard to listen to these calls.

Source: Bianco Research

What's been said:

Discussions found on the web: