My afternoon train reads:

• Here’s Stephanie Kelton’s Tremendous Presentation On The Fiscal Cliff, And The Potential Tragedy Of A ‘Deal'(Business Insider)

• WHY I COULD NOT VOTE OBAMA: An Economic Team Unwilling to Sweep Wall Street Clean (Bloomberg)

• Stephanie Kelton’s Presentation On Fiscal Cliff, And The Potential Tragedy Of A ‘Deal’ (Business Insider)

• Hard Lessons in Modern Lending (Inc.)

• How much did banks pay to become too-big-to-fail and to become systematically important? (EconPapers) see also Election Leaves Uncertainty for Adviser Regulation (WSJ)

• Asia Pacific REIT Market Could Swell to $500 Billion (World Property Channel)

• In Sports or Business, Always Prepare for the Next Play (Business Day)

• Why Do Trees Topple in a Storm? (Scientific American)

• Scientists uncover a new pathway that regulates information processing in the brain (Science Codex)

• After Sandy, a great and complex city reveals traumas new and old (Capital New York)

• An ancient civilization’s wet ascent, dry demise (Science News) see also Why Antarctic sea ice cover has increased under the effects of climate change (Antarctica)

What are you reading?

Looking Past Fiscal Cliff to Fixing Taxes

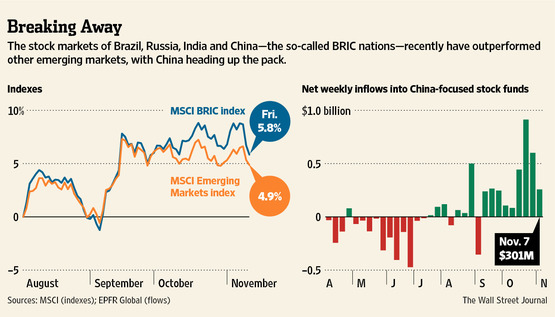

Source: WSJ

What's been said:

Discussions found on the web: