Key Data Points1

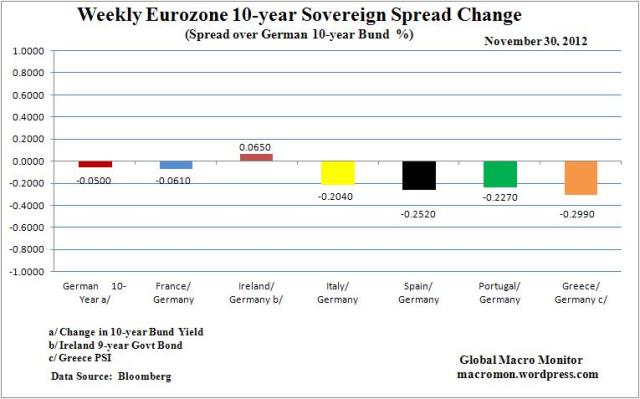

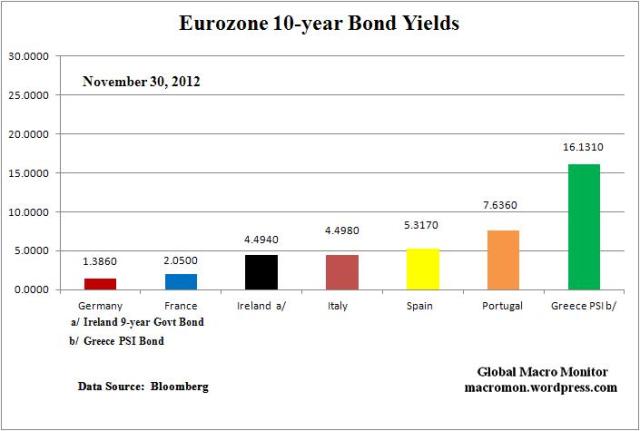

German 10-year Bund 5 bps lower;

France 10-year 6 bps tighter to the Bund;

Ireland 7 bps wider;

Italy 20 bps tighter;

Spain 25 bps tighter;

Portugal 23 bps tighter;

Greece 30bps tighter;

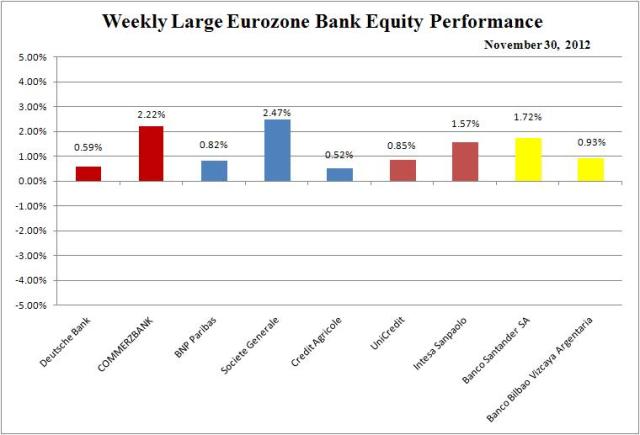

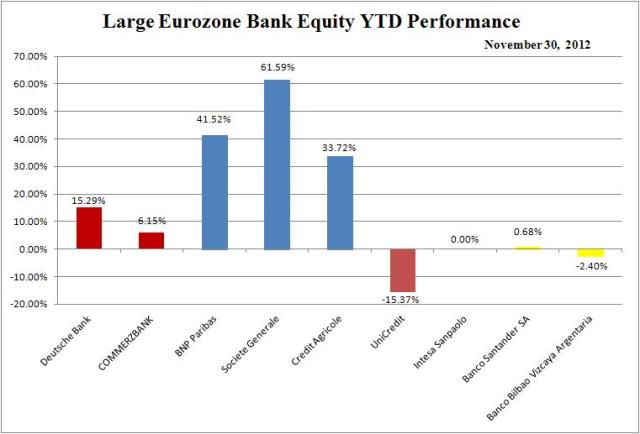

Large Eurozone banks up 0.5-3 percent;

Euro$ up 0.33 percent.

Comments

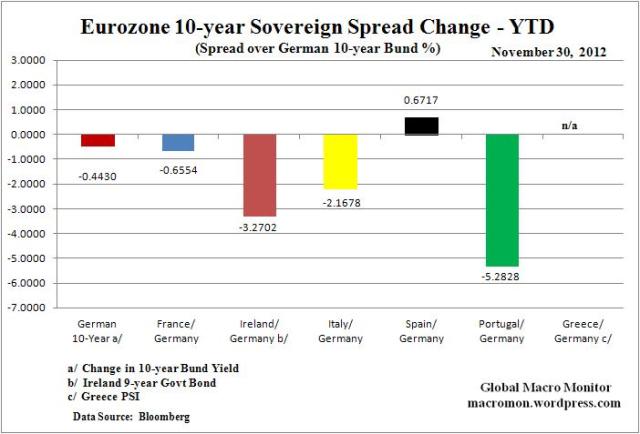

– France, Italy, and Greece 10-year yields at lowest weekly close of the year;

– Rumors circulate about downgrade of ESM and EFSF bailout funds;

– Bundestag approves Greek deal without the Chancellor’s Majority and only with the support of the opposition – 473 MPs in favor and 100 MPs against, 100 MPs abstained;

– October youth unemployment rate in Eurozone rises to 23.9 percent, up from 21.9 percent a year ago;

Not all countries have the same sense of urgency as some months ago.

– José Manuel Barroso, President of the EC

(click here if charts are not observable)