Source: ECRI

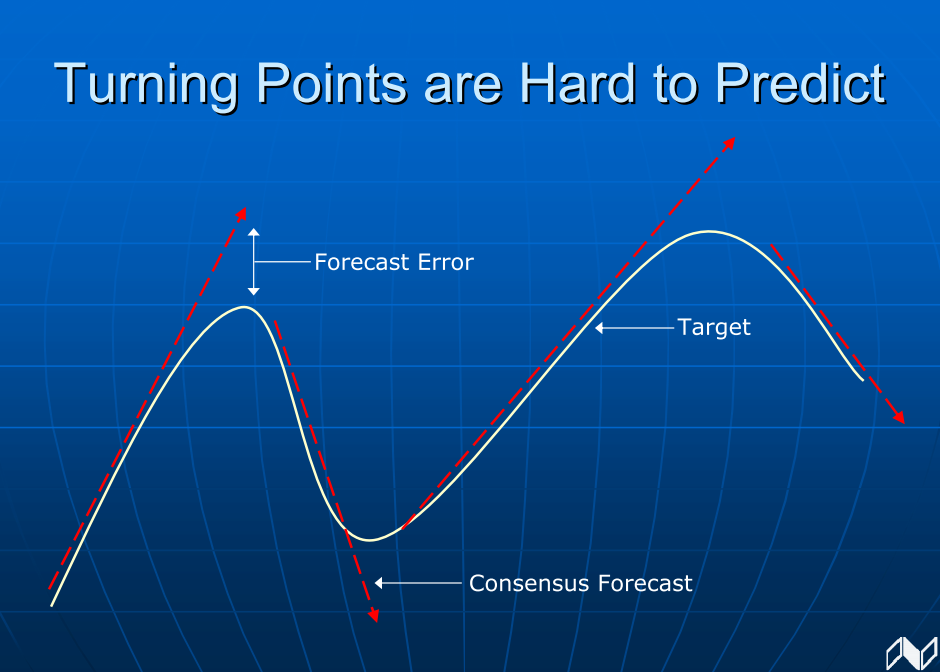

The obvious answer is that extrapolation of current trends into infinity fails in any data set that is cyclical .

The Short Side of Long takes a swipe at the question, writing:

“The fact is, most economists are totally useless at predicting recessions. According to Variant Perception (I recommend reading their leading indicator economic research), “in the past four US recessions consensus forecasts did not recognise the recession even when recessions had already started.” The problem with economists and other academics is that they simply extrapolate data trends, as seen in the chart above. Variant Perception goes onto argue that the reason 9 out of 10 economists have failed to forecast the last several recessions is because economists focus on the wrong things. The two major reasons are:

• Focusing on lagging economic indicators (e.g. no use in tracking employment data)

• Focusing on incomplete / untrue data (e.g. almost all data is revised 3 & 12 months later)”

Hard to argue with any of that.

I have made my case over the years . . .

What's been said:

Discussions found on the web: