vlivk for ginormpous graphic

Source: NYT

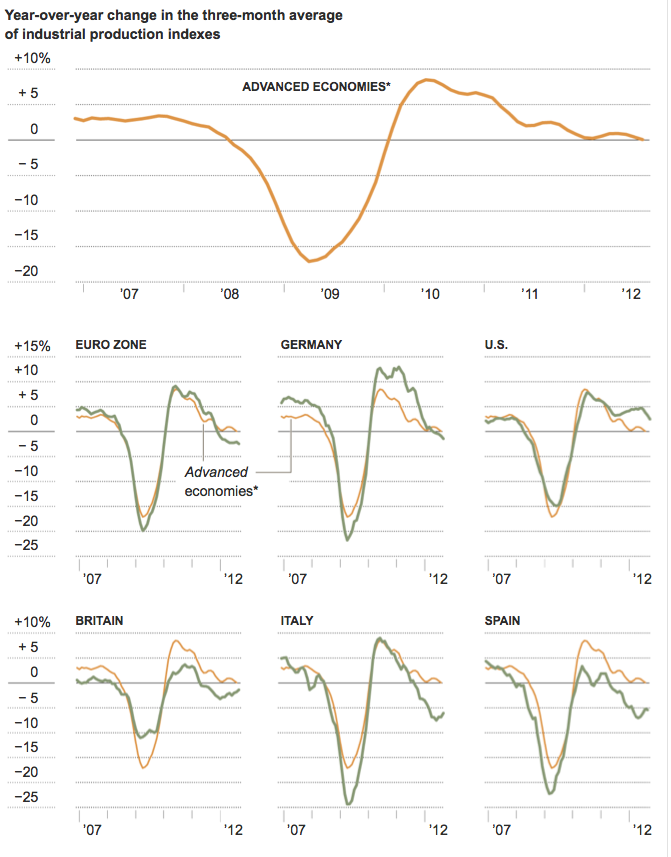

Floyd Norris points out that “industrial production has been stagnating in many advanced economies around the world and is beginning to damage the German economy, which has been the strongest in the troubled euro zone.”

The US remains the healthiest of the bunch, but even Germany is tipping into contraction . . .

What's been said:

Discussions found on the web: