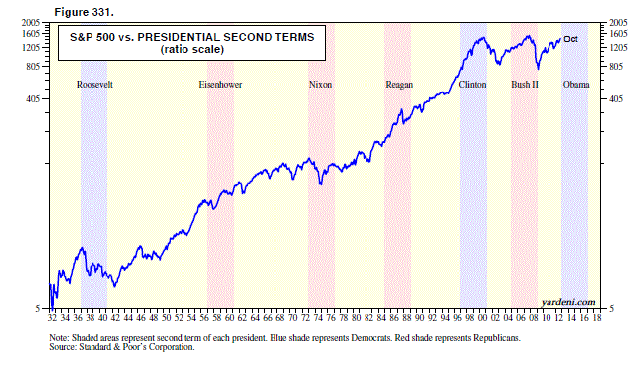

Doc Ed points out that second presidential terms are not especially kind to equities. Presidential first terms of the past 11 elected presidents starting with Franklin D. Roosevelt were up an average of 50%. However, S&P500 only rose 16% during the second terms of the past six presidents who were re-elected.

There are problems with this being a small sample set, but it is an interesting anecdotal observation nonetheless.

Hat tip Pensions & Investments

Source:

Second Terms

Ed Yardeni

Dr. Ed’s Blog, November 8, 2012

http://blog.yardeni.com/2012/11/second-terms.html

What's been said:

Discussions found on the web: