My morning reads:

• Visual History Of The S&P 500 (ETF Database)

• Skidelsky: Models Behaving Badly (Project Syndicate)

• Mayan Calendar prediction: December 21 2012 the end of the world? Nonsense, scientists say (ABC Action News)

• Visual History Of The S&P 500 (readwrite social)

• Banks See Biggest Returns Since ’03 as Employees Suffer (Bloomberg)

• The media discovers the ‘chained CPI’ (Columbia Journalism Review)

• Google Maps for iPhone Returns Better Than Ever (All Things D) see also Facebook Prepares to Bring Video Ads to News Feed, Aims for TV Dollars (Ad Age)

• Hack Your Life in One Day: A Beginner’s Guide to Enhanced Productivity (lifehacker)

• Why isn’t Obama demanding corporate welfare cuts? (MarketWatch) see also Why Republicans need to help Obama (Fortune)

• BuzzFeed Best of 2012 (BuzzFeed)

What are you reading?

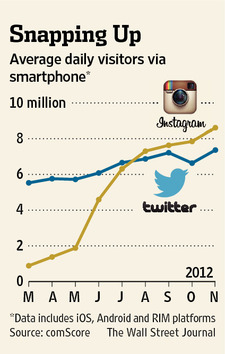

With Instagram, Facebook Spars With Twitter

Source: WSJ

What's been said:

Discussions found on the web: