My afternoon train reads:

• Higher interest rates would help bring normality back to the banks (The Telegraph) see also Muni Rally Approaches Limit With 47-Year Low Yields (Bloomberg)

• Warren’s Way: Lunch with Warren Buffet (The New Yorker)

• Wall Street finds a foreign detour around U.S. derivatives rules (Reuters)

• Degree Inflation? Jobs That Newly Require B.A.’s (Economix) see also For MBAs, Wall Street Loses its Luster (Businessweek)

• Companies In Trouble and Paying Out Big Bonuses (WSJ)

• Social Security and its role in the nation’s debt (Washington Post) see also Tax Hit Looms on Mortgage Relief (WSJ)

• Your New TV Ruins Movies (Prolost)

• Republicans blaming Mitt Romney for losing the public are actually having an argument about their own party (The Economist) see also Does the GOP need a religious retreat? (Yahoo News)

• 2012: The Year in Photos, Part 1 of 3 (The Atlantic)

• Scientific consensus shifts public opinion on climate change (The Conversation) see also Polar ice sheets melting – in pictures (Guardian)

What are you reading?

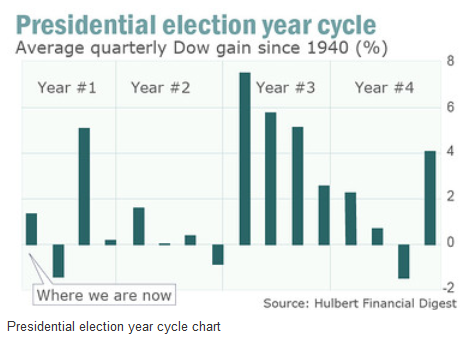

Stocks volatile early in presidential cycle

Source: MarketWatch

What's been said:

Discussions found on the web: