My afternoon train reads:

• Economics may be dismal, but it is not a science (John Kay)

• Gold-hunting in a frugal age (The Economist)

• The myth of shareholder value (Gordon Pearson) see also Down With Shareholder Value (NYT)

• Why these business owners are hiring (CNN Money)

• Apple, strategists and the proprietary software problem (FT Alphaville)

• How President Obama’s campaign used big data to rally individual voters, part 1. (Technology Review)

• Can’t Think of a Good Holiday Gift? Give a Bad One (Psychology Today)

• Have Scientists Found Two Different Higgs Bosons? (Scientific American) see also Double trouble (Babbage)

• The First Time Tech Ruined the Music Business (Echoes)

• Louis C.K.: The Proust Questionnaire (Vanity Fair)

What are you reading?

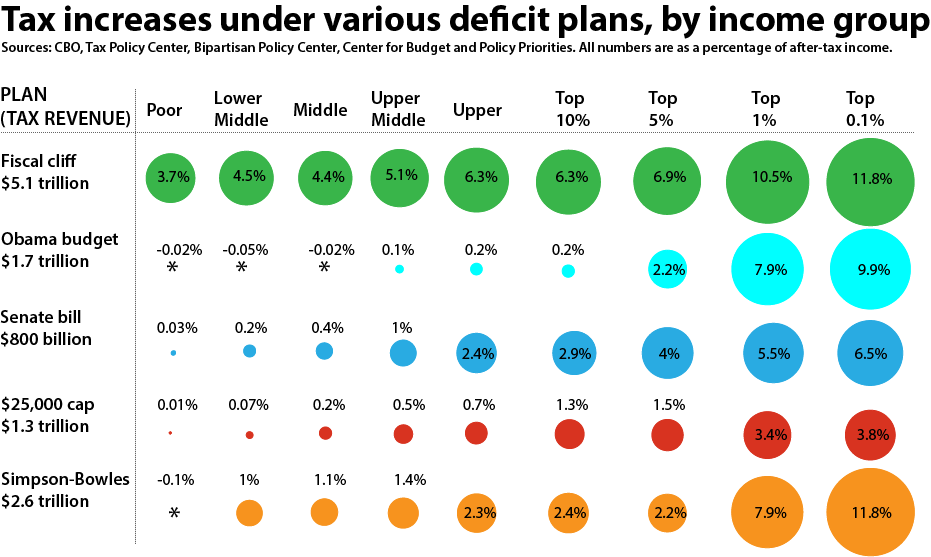

How the ‘fiscal cliff’ will affect your taxes

Source: Washington Post

What's been said:

Discussions found on the web: