My Sunday morning reads:

• Ben Bernanke’s Secret Message to Congress: More Stimulus, Please (The Atlantic)

• Why Robert Khuzami Would Be a Terrible Choice to Head the SEC Given Read (naked capitalism) see also ‘Whale’ Capsized Banks’ Rule Effort (WSJ)

• Obama Eyes $108 Billion Annual Asia Prize Vying With China Trade (Bloomberg)

• History lesson: Why the Bush tax cuts were enacted (Washington Post) see also Zachary Karabell: The bright side of the fiscal cliff (Reuters)

• Nassim Taleb: My rules for life (The Guardian)

• Federal Power to Intercept Messages Is Extended (NYT)

• Greenland and Antarctica ‘have lost four trillion tonnes of ice’ in 20 years (Guardian) see also 2012 Arctic Report Card (Climate Watch)

• IQ ‘a myth,’ study says (The Star)

• Clout Diminished, Tea Party Turns to Narrower Issues (NYT) see also Is Fox Even Helping the Republicans Anymore? (Huffington Post)

• 6 Simple Rituals To Reach Your Potential Every Day (Fast Company)

What are you doing this New Year’s Eve?

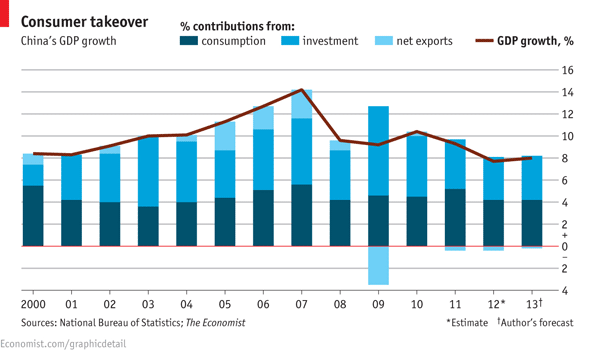

Chinese growth faces a more sober economy in 2013

Source: The Economist

What's been said:

Discussions found on the web: