My morning reads:

• 2012: The year of bank fraud (Reuters)

• And still, no criminal charges: Leniency Denied, UBS Unit Admits Guilt in Rate Case (DealBook) see also UBS Trader Hayes Exposed at Core of Libor Investigation (Bloomberg)

• Investment Fads and Themes by Year, 1996-2012 (The Reformed Broker)

• Fed’s $4 Trillion Rescue Helps Hedge Fund as Savers Hurt (Bloomberg) see also Fed Up With the Fed (Barron’s)

• 10 ways index funds can save your retirement (MarketWatch)

• Fiscal Clifford the dog:

…..-Obama and Boehner Diverge Sharply on Fiscal Plan (NYT)

…..-White House Said to Tell Business Groups Talks Stall (Bloomberg)

• Shiller: Housing Hasn’t Necessarily Bottomed Yet (Pragmatic Capitalism)

• Corporations are the people of the year, my friend (Quartz)

• The Worst CEOs of 2012 (Businessweek)

• The 25 Funniest AutoCorrects Of 2012 (BuzzFeed)

What are you reading?

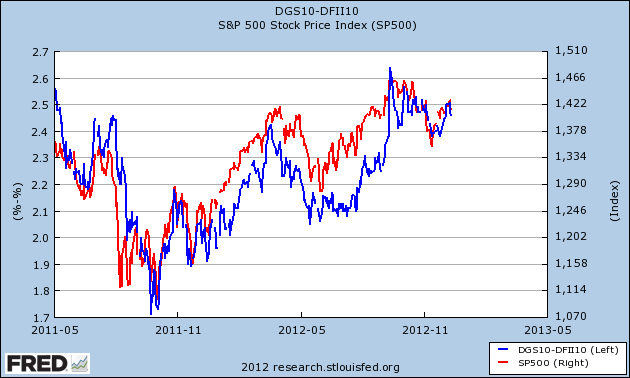

Stocks Love Inflation

Source: Crossing Wall Street

What's been said:

Discussions found on the web: