My morning reads:

• CFTC Study: High-Speed Trades Hurt Investors (NYT)

• With Higher Taxes Ahead, Stocks Are the Stuffing for Many Givers (WSJ)

• Study: At most a third of us show a consistent approach to financial risk (MIT News)

• U.S. Sues Chinese Arms of Big Auditors over “accounting debacles” (WSJ)

• Bloomberg Sequestration twofer:

…..-Obama Bets Re-Election Gave Him Power to Win Fiscal Cliff (Bloomberg)

…..-Republicans Reprise 2011 Debt-Limit Threat in Cliff Talks (Bloomberg)

• Southeast Asia’s Growing Appeal (WSJ)

• Microsoft-Intel Push to Combat Apple in Tablets Sputtering (Bloomberg)

• Fox News chief’s failed attempt to enlist Petraeus as presidential candidate (Washington Post)

• The Story Behind The Newly Remastered Version Of ‘The Grey Album’ (Forbes)

• Mapping America’s Most Embarrassing Addresses (Curbed)

What are you reading?

>

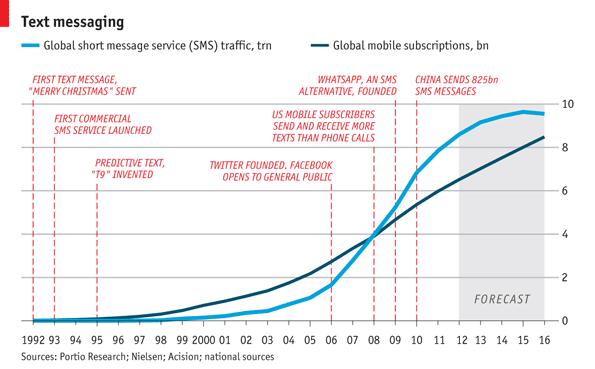

OMG! Texting turns twenty

Source: The Economist

What's been said:

Discussions found on the web: