My afternoon train reads:

• Should You Secular Market Time? (Yes, based on Valuations) (Rick Ferri)

• If Investors Are Dumping Stocks, Why Are ETFs So Hot? (The Fiscal Times) see also US stock market rally deserves respect (FT Alphaville)

• The VIX – Is It Telling Us Anything? At All? (Pragmatic Capitalism)

• Scaring Retail Investors? Mission Accomplished (The Reformed Broker) see also For Many Financial Advisers, Stocks Become a Hard Sell (WSJ)

• Republicans have surrendered on fiscal cliff (MarketWatch)

• TODAY IN APPLE NEWS: Apple’s Big Manufacturing Boom to the U.S.—200 Jobs (The Fiscal Times) see also Apple Not Seen Paying

• A Warning About That Guy Who Is Beating the Market (Bucks)

• Hostess took workers’ pension money to fund itself (Daily Kos) see also Hostess Maneuver Deprived Pension (Yahoo Finance)

• How to Control an Army of Zombies (NYT)

• The Case for Drinking as Much Coffee as You Like (The Atlantic)

What are you reading?

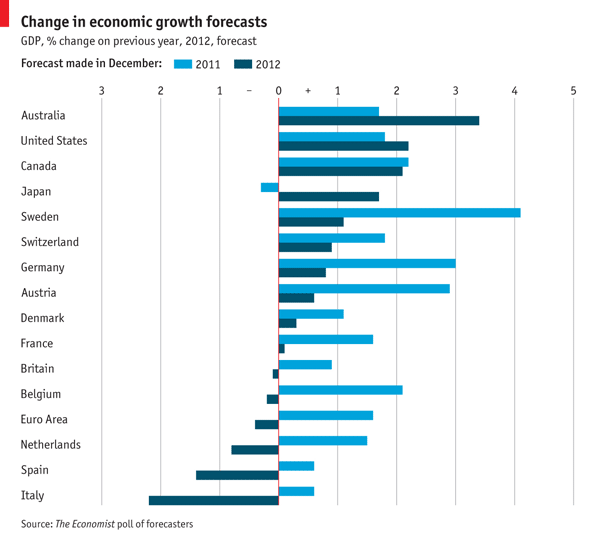

Precarious predictions

Source: The Economist

What's been said:

Discussions found on the web: