Source: Adam Parker, Morgan Stanley

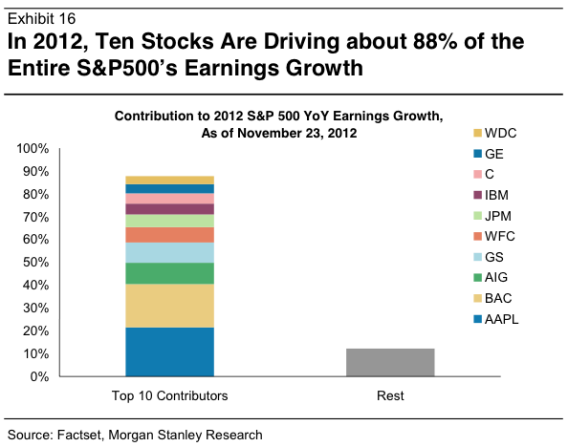

Today’s absurd datapoint comes from Slate’s Moneybox: 88% of the S&P500 earnings growth for 2012 came from just 10 firms.

Just four companies—Apple, AIG, Goldman Sachs, and Bank of America—together provided a majority of overall earnings growth among large-cap companies.

Source:

Four Companies That Together Provided Most of 2012 Earnings Growth in the S&P 500

Matthew Yglesias

Slate, Nov. 26, 2012

http://slate.me/Xeb6SD

What's been said:

Discussions found on the web: