Little Support for Most Specific Deficit Options

Source: Pew Research

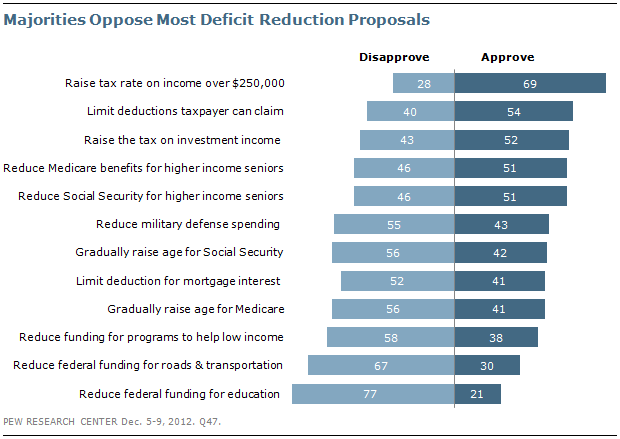

Lots of people like to talk about deficit reductions. No one really wants to do anything about it.

That is not an exaggeration. Despite all of the back and forth over the fiscal cliff and the deficits, when you get specific about deficit reduction, the majority of Americans are not supportive.

Source:

Little Support for Most Specific Deficit Options

Pew Research Center December 13, 2012

http://www.people-press.org/2012/12/13/as-fiscal-cliff-nears-democrats-have-public-opinion-on-their-side/

What's been said:

Discussions found on the web: