This has not been a great year for Hedge Funds. As The Economist reported, the “HFRX, a widely used measure of industry returns, is up by just 3%, compared with an 18% rise in the S&P 500 share index.”

This has not been a great year for Hedge Funds. As The Economist reported, the “HFRX, a widely used measure of industry returns, is up by just 3%, compared with an 18% rise in the S&P 500 share index.”

This is not a mere one off, a single year’s underperformance, but rather, symptoms of a much deeper, longer lasting problem:

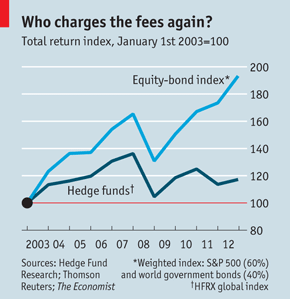

“The S&P 500 has now outperformed its hedge-fund rival for ten straight years, with the exception of 2008 when both fell sharply. A simple-minded investment portfolio—60% of it in shares and the rest in sovereign bonds—has delivered returns of more than 90% over the past decade, compared with a meagre 17% after fees for hedge funds (see chart below). As a group, the supposed sorcerers of the financial world have returned less than inflation.”

Now, there are a few caveats to this:

Sturgeons law certainly applies to the more than 8000 Hedge funds. If you are lucky enough to be invested with the top decile of managers this year, they have “served up returns of over 30%.” And the very top tier of hedgies have crushed it over the past (insert your preferred time period here) ____ .

But that’s looking backwards — its quite easy to say who were the best performing hedge funds the past decade. The trick is being able to identify who will be the best performers over the next decade. That is a skillset that even the biggest and best endowments, pension funds and individual investors seem to lack.

Note that these issues are before we even reach the question of enormous 2&20 fee structure. “Gallingly,” writes The Eeconomist, this underperformance comes as “the profits passed on to their investors are almost certainly lower than the fees creamed off by the managers themselves.”

Expect this to be a continuing issue int he coming decade.

Previously:

How Hard is it to Become the Michael Jordan of Trading? (July 14th, 2011)

Source:

Hedge funds Going nowhere fast

Economist, Dec 22nd 2012

http://econ.st/VQciW5

What's been said:

Discussions found on the web: