Once again, its time to peruse the data to see which books TBP readers bought last month. Amazon’s embed code lets me track every click from these links — how many people look at the page, how many books get seen, and/or collectively purchased.

Its anonymous — I don’t know who bought what — but there’s lots of data on the various books generated.

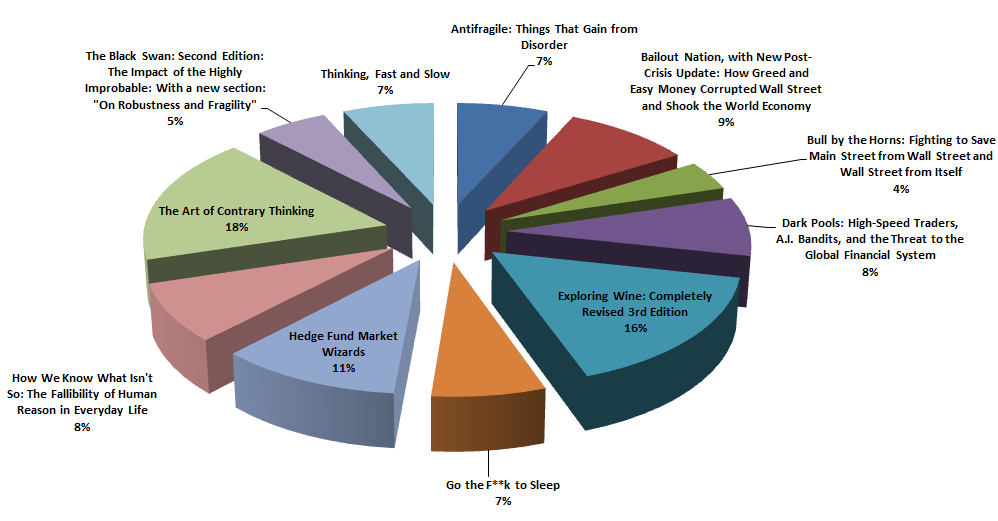

These were the most popular TBP books for November:

Antifragile: Things That Gain from Disorder (Nassim Nicholas Taleb)

Bailout Nation, with New Post-Crisis Update: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy (Barry Ritholtz)

Bull by the Horns: Fighting to Save Main Street from Wall Street and Wall Street from Itself (Sheila Bair)

Dark Pools: High-Speed Traders, A.I. Bandits, and the Threat to the Global Financial System (Scott Patterson)

Exploring Wine: Completely Revised 3rd Edition (Steven Kolpan)

Go the F**k to Sleep (Adam Mansbach)

Hedge Fund Market Wizards (Jack D. Schwager)

How We Know What Isn’t So: The Fallibility of Human Reason in Everyday Life (Thomas Gilovich)

The Art of Contrary Thinking (Humphrey B. Neill)

The Black Swan: Second Edition: The Impact of the Highly Improbable: With a new section: “On Robustness and Fragility” (Nassim Nicholas Taleb)

Kindle and eBooks after the jump

Click to enlarge:

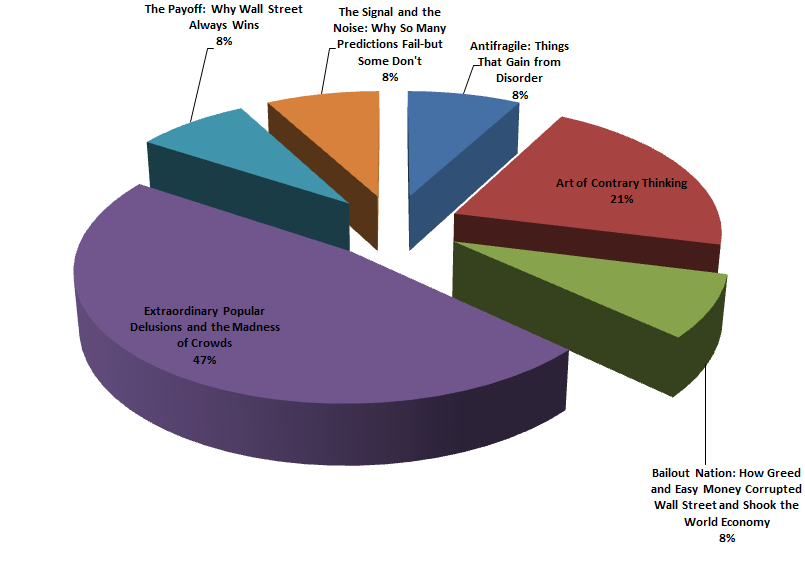

These were the most popular TBP Kindle eBooks for November:

Antifragile: Things That Gain from Disorder (Nassim Nicholas Taleb)

Art of Contrary Thinking (Humphrey Bancroft Neill)

Bailout Nation: How Greed and Easy Money Corrupted Wall Street and Shook the World Economy (Barry Ritholtz)

Extraordinary Popular Delusions and the Madness of Crowds (Charles Mackay)

The Payoff: Why Wall Street Always Wins (Jeff Connaughton)

The Signal and the Noise: Why So Many Predictions Fail-but Some Don’t (Nate Silver)

What's been said:

Discussions found on the web: