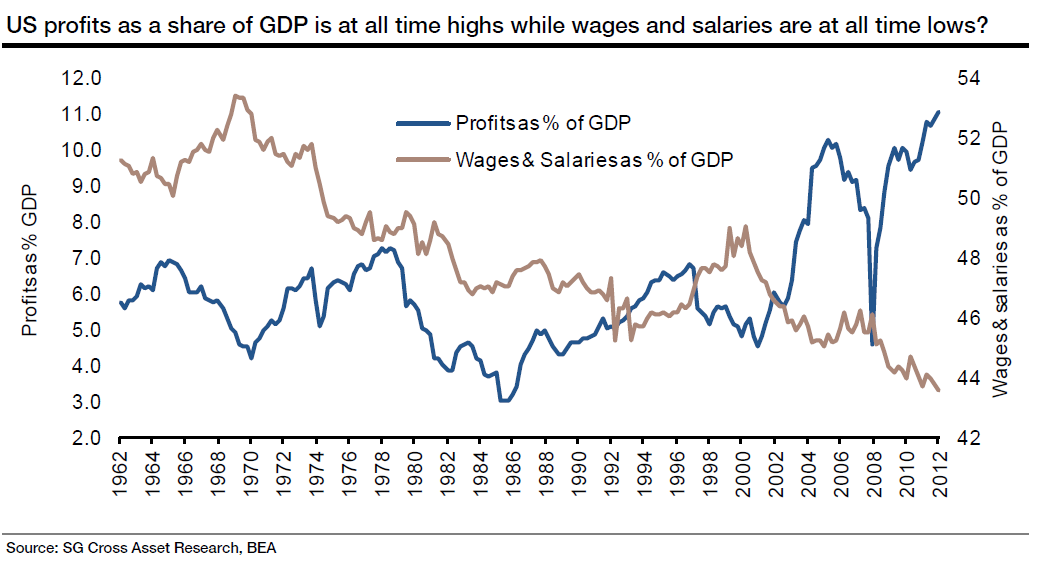

The latest Q3 US national accounts data shows profits as a share of GDP are at historical highs. Meanwhile household’s share is at all time lows (see chart).

Will pressure from the electorate force to address this imbalance?

In the UK, we witnessed just what SocGen described as “the public lynching of Starbucks, Amazon and Google” as public ire has shifted “very swiftly from banker bashing to corporate bashing.”

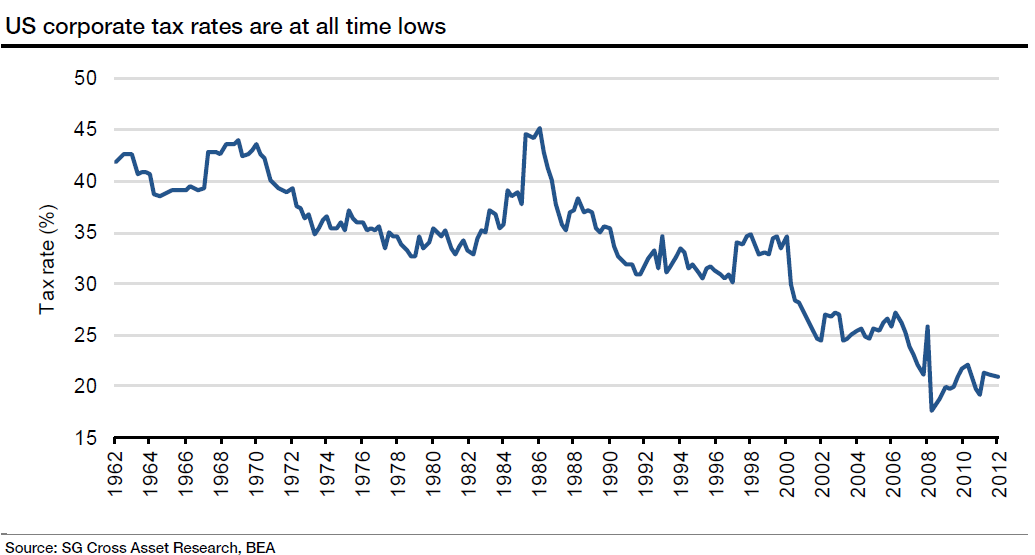

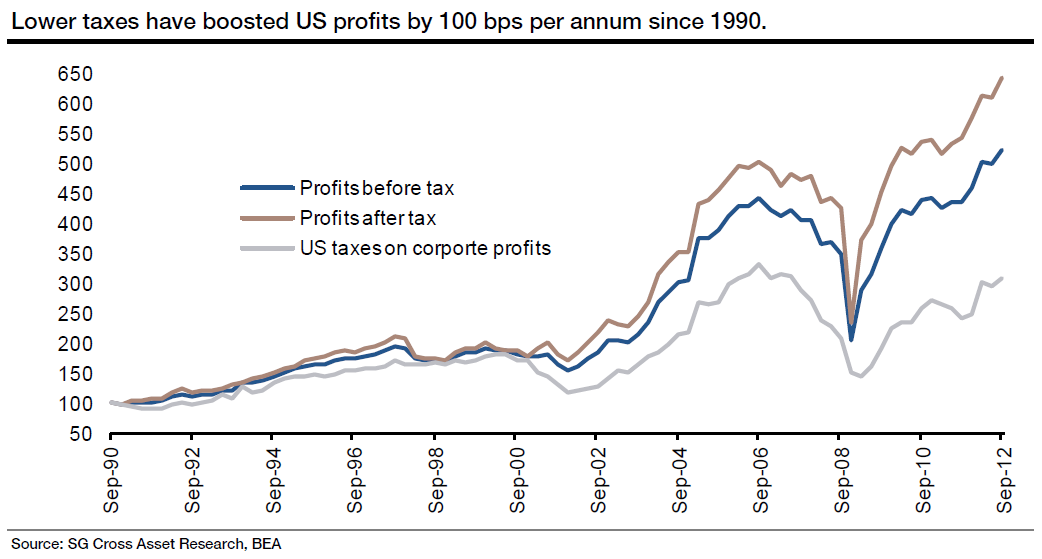

Forget the official tax rate, and look at the actual tax dollars US and European companies have been paying.

Societe Generale warns that there is risk to these rates going forward — and that could have implications for profitability.

Source:

Quant Quickie

Societe Generale

http://www.societegenerale.com/en

What's been said:

Discussions found on the web: