Source: Miller Samuel Inc.

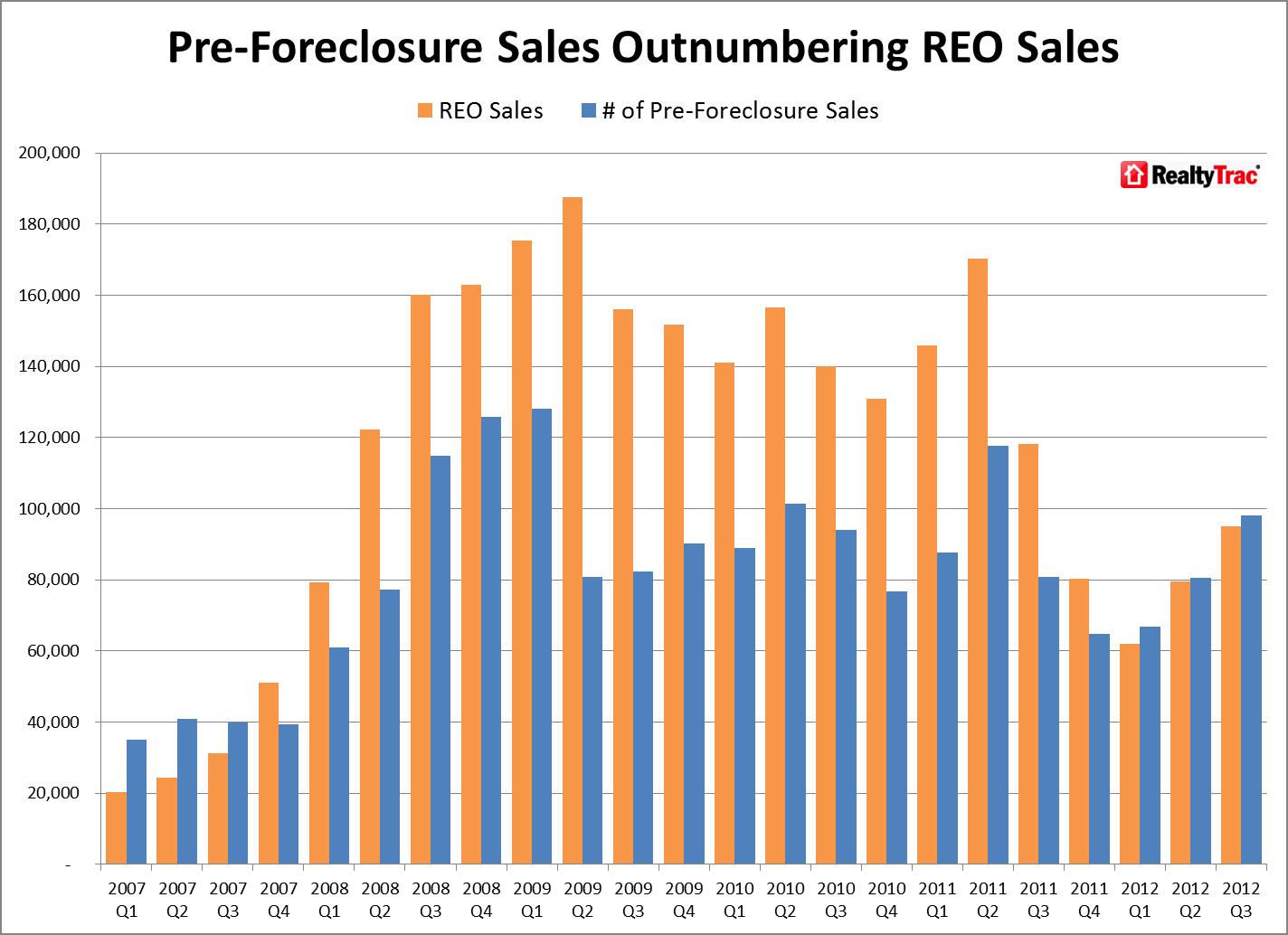

Jonathan Miller shows us the above chart (via RealtyTrak) and ask the question: How does flat to falling incomes, high unemployment, rising taxes and tight credit = housing recovery?

The short answer is a combination of record low mortgage rates and held back distressed activity. Following a weak 2011, year-over-year comparisons also look good.

The combination goosed housing sales and prices. The question for the housing bulls is, can it continue?

The answer, at least from this (personally long) housing bear is low rates in 2013 will confront rising foreclosure sales. That battle — plus the state of the consumer as outlined by Jonathan — will determine whether this year’s improvement in housing will continue next year.

Additional bullet points after the jump

• 2008-2010 – Heavy foreclosure volume as a result of the fallout from the tanking economy and housing market

• 2010 (fall) – Robo-signing scandal combined with huge backlogs in judicial states causes a sharp decline in distressed sales entering the market in 2011.

• 2012 (1Q) Major servicer agreement with state attorneys general as distressed volume drops to its lowest crisis level.

• 2012 Calculated Risk and other respected sources call the bottom (and they may be right) but doesn’t factor in the distressed sale phenomenon. “Bottom” does not equal “recovery” but rather it’s a step on the way to recovery.

• 2012 (2Q) Distressed sales begin to rise again. By adding lower priced distressed sales in the mix, housing prices stabilize or slip next year nationally (I see Manhattan rising with low distressed exposure and limited inventory).

Source:

Ignore The False Positives, Foreclosure Sales Are Rising Again Now Posted by Jonathan Miller

Miller Samuel, December 6, 2012

http://www.millersamuel.com/blog/ignore-the-false-positives-foreclosure-sales-are-rising-again-now/27460

What's been said:

Discussions found on the web: