~~~

I meant to get to these yesterday, but was too busy working on tonight’s Best of Music for 2012 post. A man’s got to have his priorities!

S&P:

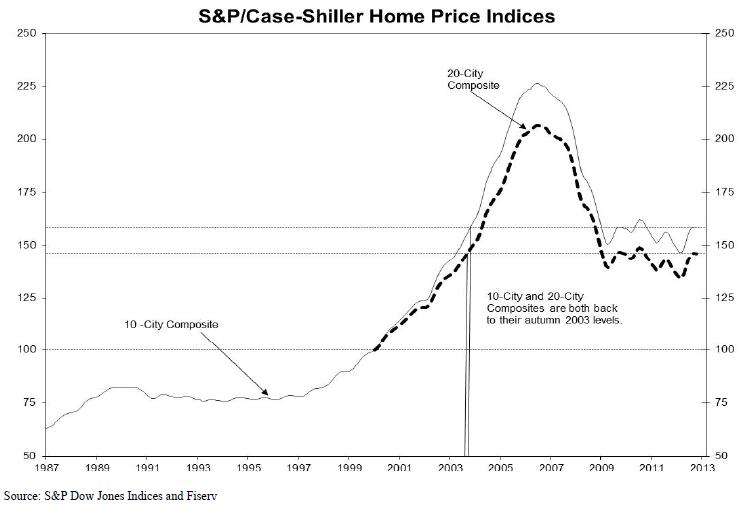

The chart above depicts the annual returns of the 10-City Composite and the 20-City Composite Home Price Indices. In October 2012, the 10- and 20-City Composites recorded respective annual increases of 3.4% and 4.3%, and monthly declines of 0.1% each.

Source:

Sustained Recovery in Home Prices According to the S&P/Case-Shiller Home Price Indices

David Blitzer & Dave Guarino

S&P Indices, December 26, 2012

What's been said:

Discussions found on the web: