Tail Risk And The Market Bears

An unusual pattern is developing when it comes to market opinion. No one is turning bearish anymore.

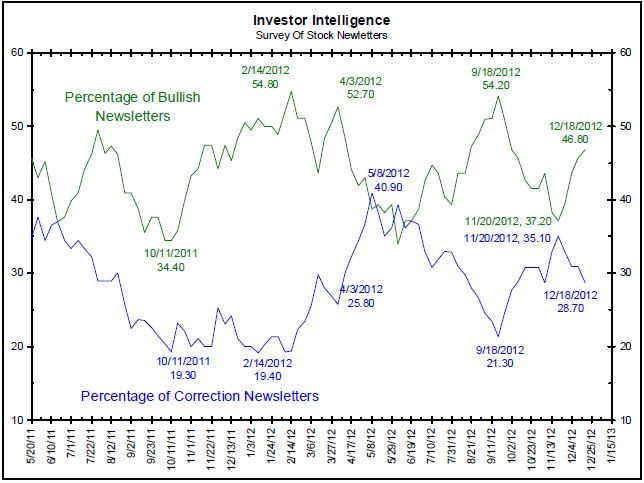

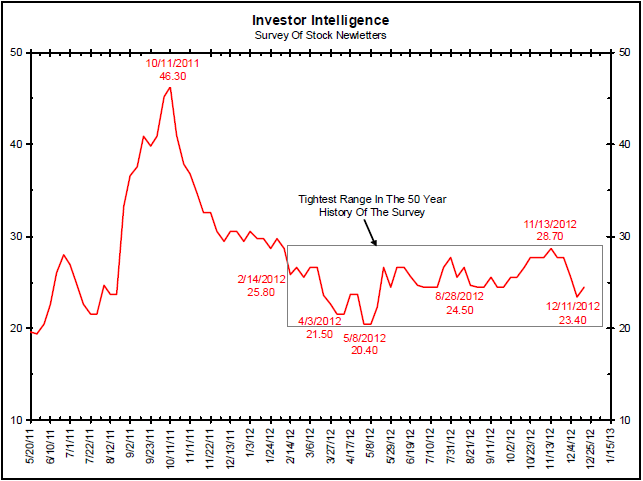

The charts to the right show the Investor’s Intelligence survey of stock market newsletter writers. The green line in the top chart shows the percentage of bullish newsletter writers. The blue line shows the percentage of newsletter writers who are bullish but expecting a 10% correction first. The red line in the bottom chart shows the percentage of bearish newsletter writers.

As we pointed out in July:

It is very unusual for the percentage of bullish newsletters (green line) to come down this much without a meaningful rise in the percentage of bearish newsletters (red line). We believe the underlying belief of QE3, and its potential to boost stock prices, is the reason for this action. Newsletters writers recognize the market’s poor technical position, but they also recognize that the Federal Reserve has a printing press which it has repeatedly used over the last five years. So, they are reluctant to turn outright bearish. The presence of the Federal Reserve is affecting the overall view of the stock market.

Tail Risk And The Market Bears 2

According to the gray box on the second chart on the previous page, a core of newsletters writers, about 25% of respondents, are bearish. It seems nothing shakes them from their belief and nothing adds to this core. The other 75% are either bullish or see a small correction before bullishness resumes (top chart, previous page). The marketplace no longer thinks tail risk exists. We noted this last month.

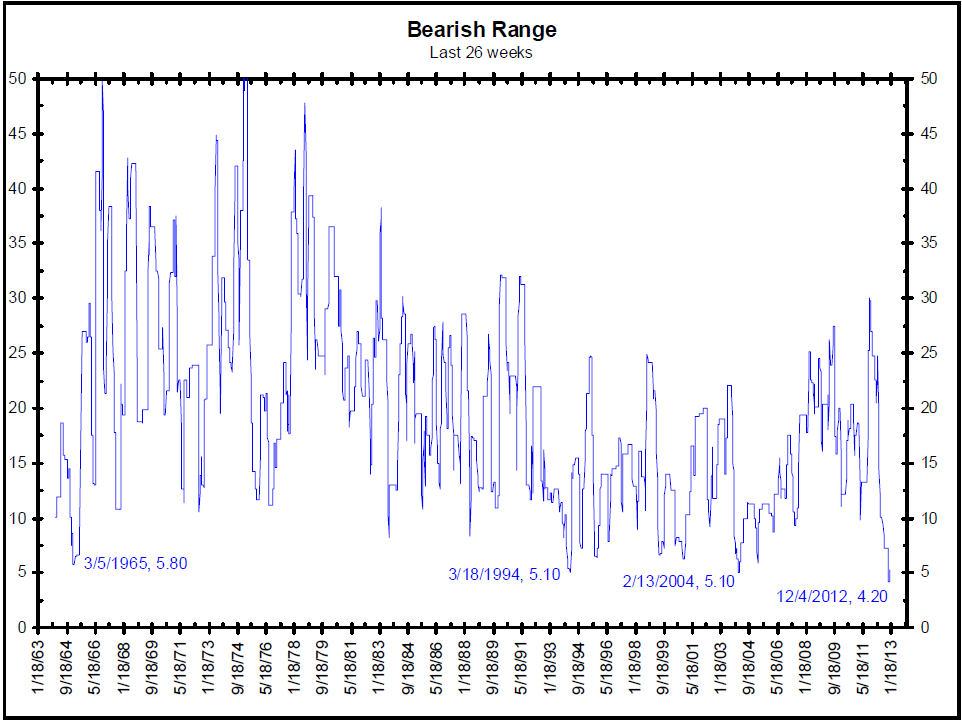

The chart to the right shows the 26-week range of bearish newsletter writers. It is calculated by taking the highest percentage of bearish newsletters writers less the lowest percentage of bearish newsletters writers over the previous 26 weeks (gray box, second chart, previous page).

The Investor’s Intelligence survey was started in 1963 and the range of bearish newsletter writers is now at its lowest point in the last 50 years. Again, this highlights the core number of bears is unchanging.

Source: Bianco Research

What's been said:

Discussions found on the web: