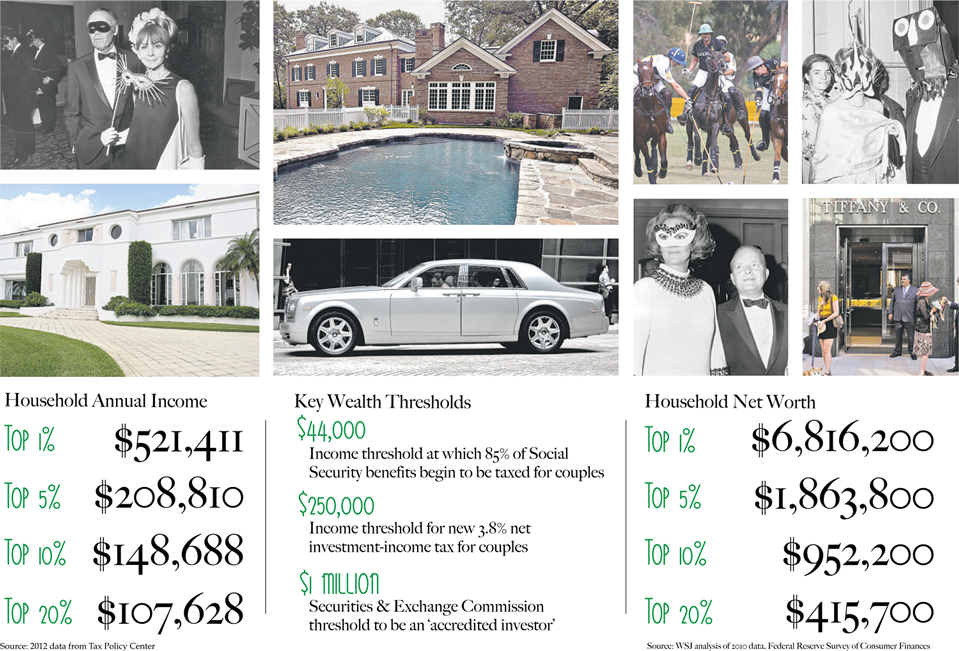

The WSJ breaks down the numbers of what it takes to be wealthy in the USA:

“The top 1% of U.S. households have a net worth above $6.8 million or at least $521,000 in income, according to data from the Federal Reserve and the Tax Policy Center in Washington. The cutoffs for the top 5% are $1.9 million in net worth, or $209,000 in income.”

Those are higher numbers than I previously had seen . . .

Source:

Baby, You’re a Rich Man

LAURA SAUNDERS

WSJ, December 28, 2012

http://online.wsj.com/article/SB10001424127887323300404578205502185873348.html

What's been said:

Discussions found on the web: