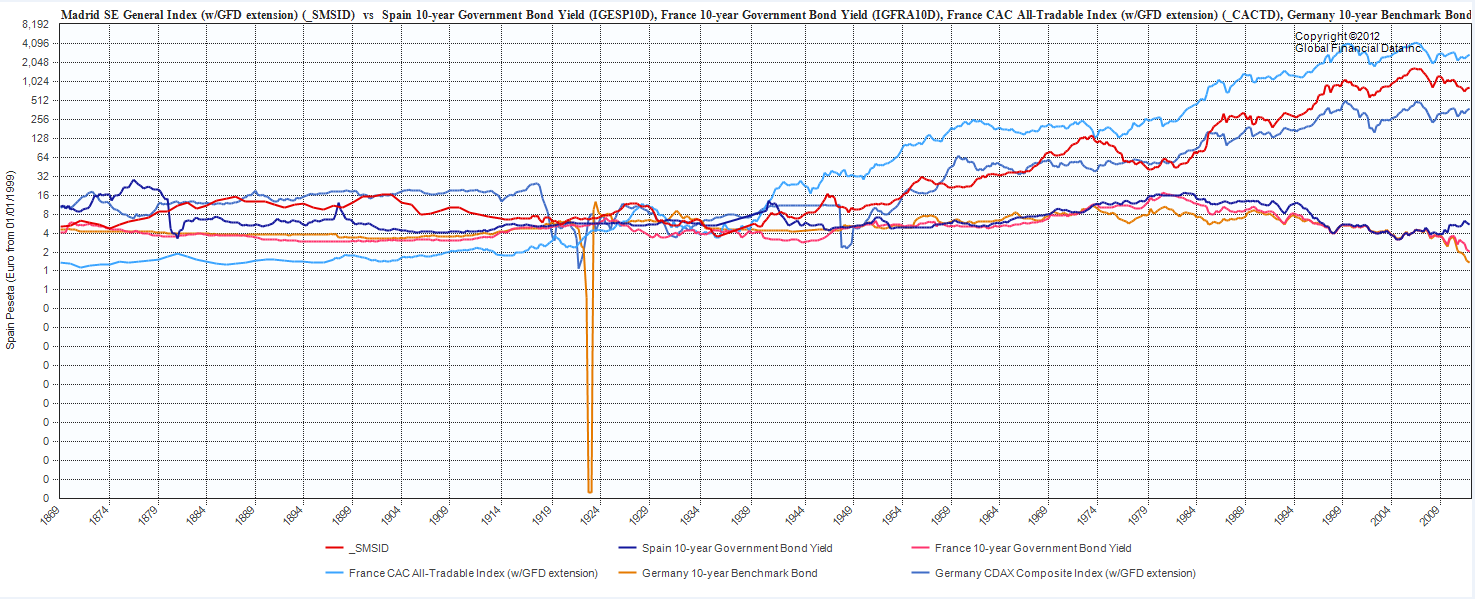

Take a look at this chart of the 10yr vs Equities to 1869

After years of negative news on well, just about everything equities have been rallying while yields are dropping. The chart below shows France, Germany and Spain, along with each’s 10 Bonds vs Equity Index back to 1869.

All three equity indices are spiking and all three yields are diving. Are we getting ready for another EU bailout?

10 Year Bonds vs Equities to 1869

click for larger chart

Hat tip Ralph M Dillon

rdillon@globalfinancialdata.com

www.globalfinancialdata.com

What's been said:

Discussions found on the web: