With tomorrow the first post Election NFP, I thought we might give Jack Welch a break and instead look at the the growth rate of federal withholding-tax collections as an early indicator of payroll changes. This data series has a strong correlation with longer term trends, and a pretty good track record for monthly Employment situation reports,

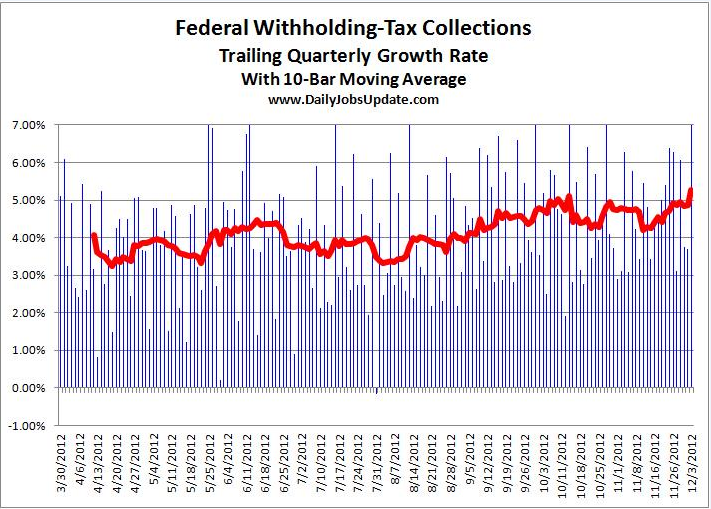

On Monday, December 5, 2012, it hit its highest level of the year as measured over the trailing quarter.

Matt Trivisonno sends along the Trailing-Quarter chart (above). He notes that “it shows a daily plot of the growth in federal withholding-tax collections for the trailing quarter ended on each day. The red line is a ten-bar moving average, and as you can see, it hit 5.26% this past Monday. That is the highest rate since we were able to resume apples-to-apples comparisons in the spring (because of the 2011 payroll tax cut).

This is very impressive: America’s payrolls are bulging despite numerous businesses being destroyed by Hurricane Sandy.

The rest of the jobs data has been lackluster, and economists have low expectations for Friday’s big non-farm payrolls report. The consensus is for only 80,000 jobs to be added, compared to 171,000 in November.

So, the odds for an upside surprise look favorable. However, keep in mind that strong NFP reports in recent months have been met with “sell the news” reactions in the stock market.”

Happy Holidays,

Matt Trivisonno

DailyJobsUpdate.com

What's been said:

Discussions found on the web: