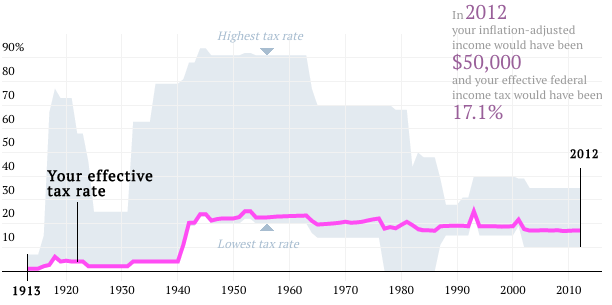

Your tax rate in 2012, and past rates since 1913

click for interactive graphic

Very nice interactive chart from Ritchie King showing our effective tax rates of 2012 versus past years.

Note that the top bracket used to be 2X what it is today.

If you your taxable income and filing status, you can see how much your total tax rate would’ve been in different eras (The NYT did something similar)

hat tip Flowing Data

What's been said:

Discussions found on the web: