Interesting chart (which we marked up) from the JEC of the U.S. Congress illustrating household net worth as a percent personal income. If that doesn’t look like a head and shoulders formation in the making, nothing does!

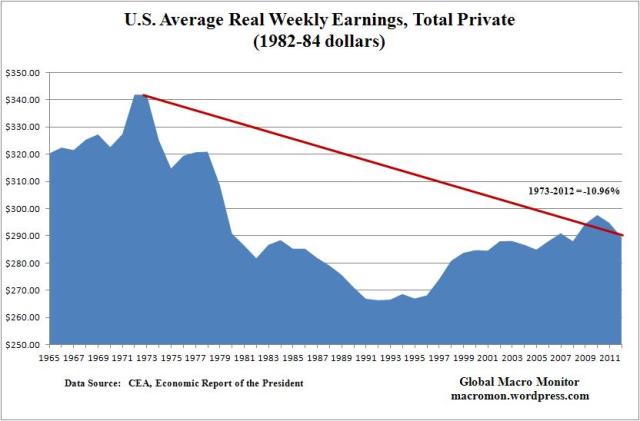

The second chart illustrates why the U.S. economy is so dependent on the wealth effect generated by asset bubbles. It’s stunning to think that average real earnings in the U.S. are almost 11 percent lower than where they were in 1973.

Policymakers’ focus should be on increasing worker productivity through: 1) reforming the country’s education system; 2) unleashing entrepreneurship; and 3) in the words of ECB chief, Mario Draghi, “doing whatever it takes” to empower small businesses.

This is tough political business, however, so we take the easy way out. The political pandering increases budget deficits, forcing the Fed to repress interest rates and print money to drive up asset prices. The boom side of the cycle is sustained longer than most expect because of the reserve currency status of the dollar. This temporarily generates artificially inflated demand (i.e, fake) through the wealth effect, which eventually collapses when asset markets crash.

Wash, rinse, repeat.

This is not a good long term economic strategy and sustainable path for permanent wealth creation, folks. It probably won’t change until it is forced upon us and then the adjustment will be more abrupt and disruptive than if policymakers were more pre-emptive.

America needs Mario Monti!

(click here if charts are not observable)

What's been said:

Discussions found on the web: