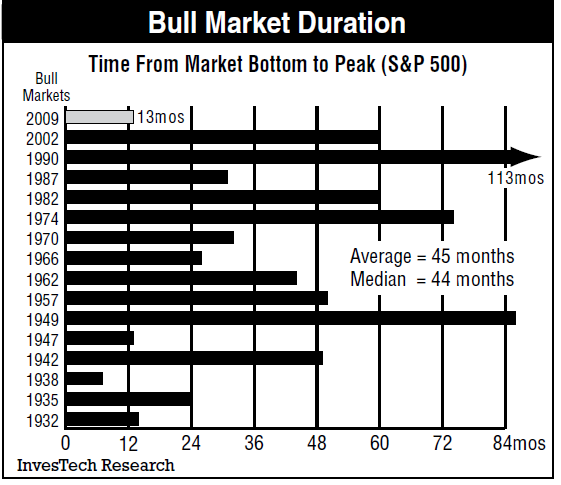

There are lots of ways to look at the question of how long cyclical bull markets run for. Each approach has specific strengths and weaknesses.

Jim Stack of Investech Research has one of the better charts: Simple straight forward, easy to understand.

The current rally that began in March 2009 is now 3.8 years old — that is the average duration of bull markets since 1929. (The current Fed interventions are the obvious wild card).

I have noted repeatedly over the years how similar this cycle was to 1973-74. That rally went over 6 years before a serious 1980 recession and correction. This is not my forecast (I don’t have one) but I would not be surprised if the current move is somewhat parallel to the post 73-74 rally.

What's been said:

Discussions found on the web: