The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most influential words were uttered by the ECB chief, Mario Draghi, in July,

“Within our mandate, the ECB is ready to do whatever it takes to preserve the euro. And believe me, it will be enough” .

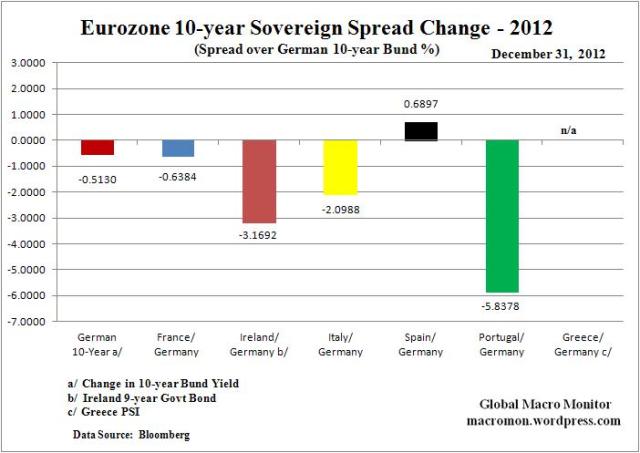

The 1o-year German bund fell 51 basis points and sovereign spreads to the bund came in big x/ Spain. French banks rebounded from their sell-off caused by excess exposure to the Eurozone periphery. The Euro strengthened against the dollar by 1.74 percent in 2012.

Political stability, growth, and unemployment will be the focus of 2013. The Eurozone’s acute crisis of rollover risk, which drove much of the global macro volatility in 2012, is over, at least, for now. All eyes still on Spain.

(click here if charts are not observable)