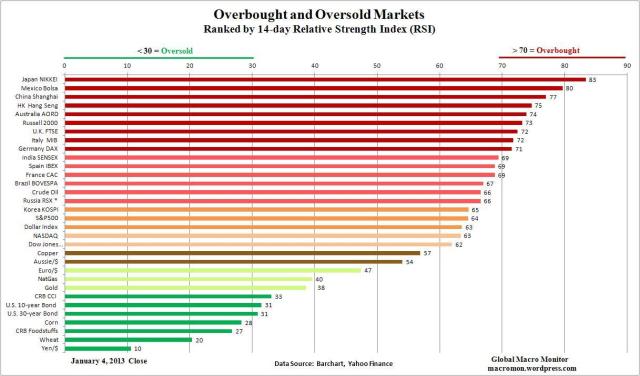

The Nikkei’s 14-day Relative Strength Index (RSI) exceeds 80 and we can’t recall ever seeing anything as short-term oversold — in a hard currency market — as the yen/dollar with its RSI of 10. The Russell 2000 is the most overbought of the U.S. equity indices with an RSI of 73. Should set up for an interesting week of consolidating last week’s big gains.

Click chart to enlarge

(click here if chart is not observable)

~~~

(click here if tables are not observable)

What's been said:

Discussions found on the web: