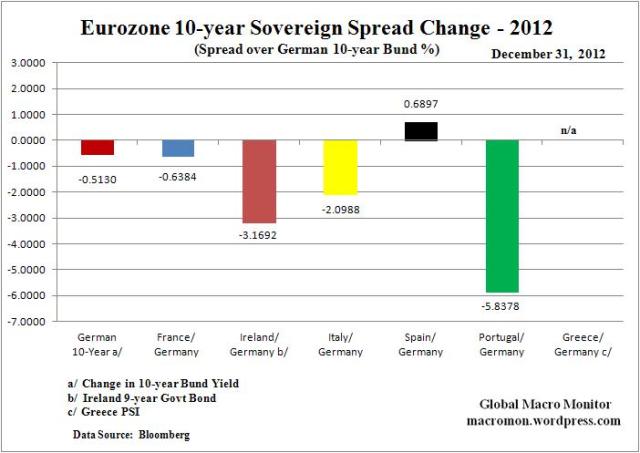

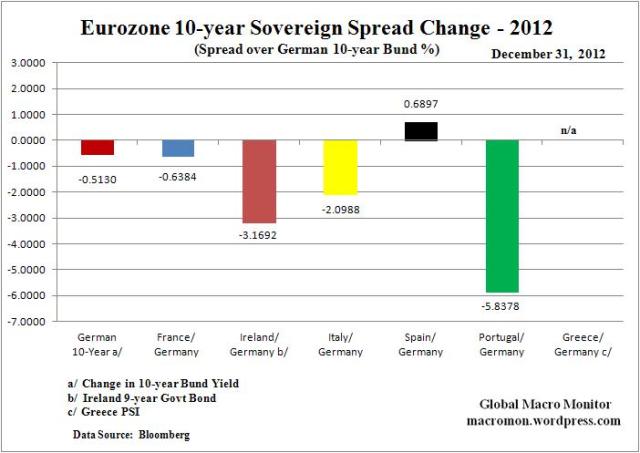

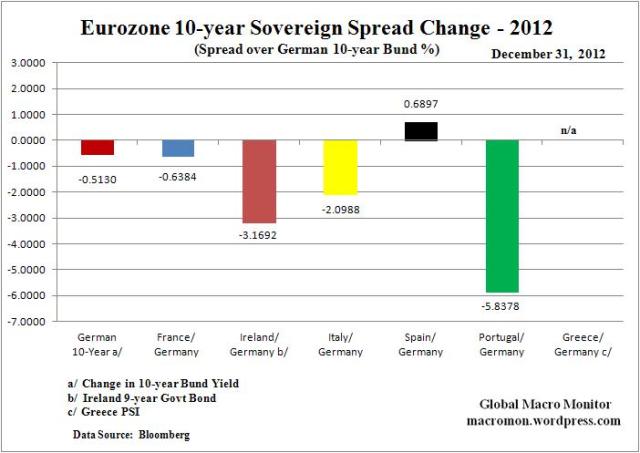

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...

Read More

There seems to have been no shortage of bears in the world over the past several years. A re-read of investment letter writers, ...

There seems to have been no shortage of bears in the world over the past several years. A re-read of investment letter writers, ...

Read More

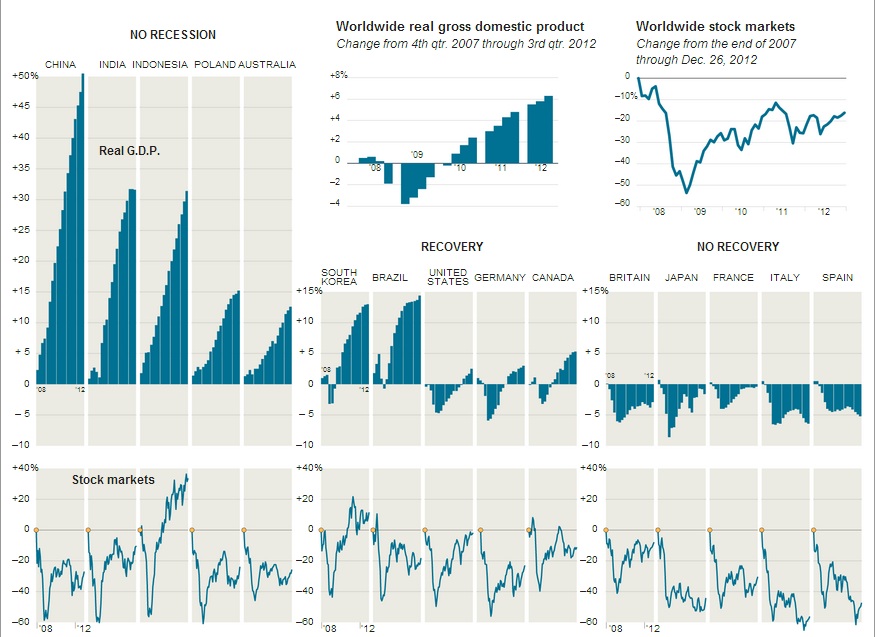

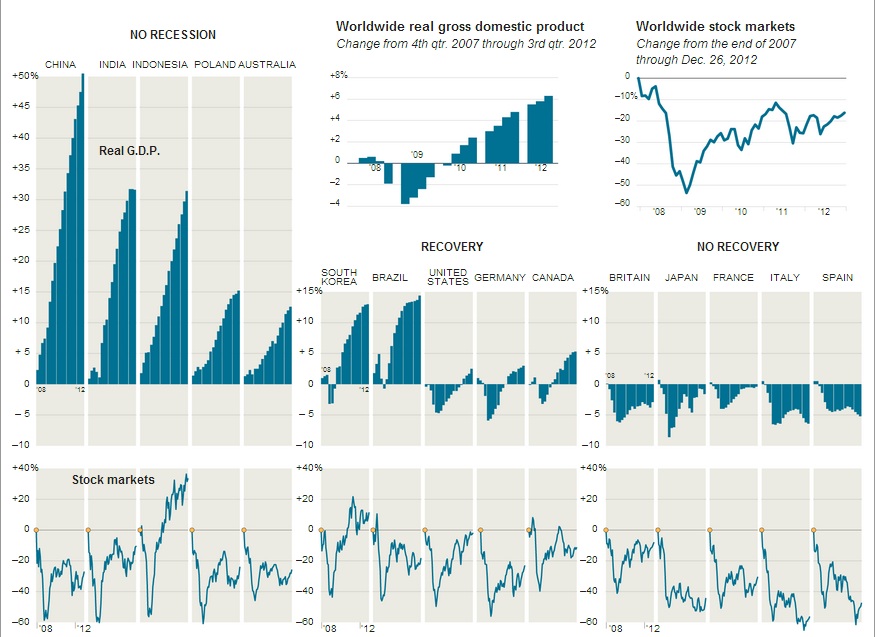

Five Years Later, Some Countries Still Lag click for ginormous graphic Source: NYT

Five Years Later, Some Countries Still Lag click for ginormous graphic Source: NYT

Read More

Housing Long-Term Outlook Is `Fuzzy,’ Shiller Says Robert Shiller, a professor at Yale University and co-creator of the...

Read More

Somewhere Over the Rainbow John Mauldin December 31, 2012 So Who’s the Optimist Now? Game-Changer: Slower Economic Growth...

Somewhere Over the Rainbow John Mauldin December 31, 2012 So Who’s the Optimist Now? Game-Changer: Slower Economic Growth...

Read More

A fantastic collection of classic beauties at Pebble Beach 2012:

A fantastic collection of classic beauties at Pebble Beach 2012:

Read More

Happy New Year’s! Start it off right with this fine reading list: • What 10 things should you do every day to improve your life?...

Happy New Year’s! Start it off right with this fine reading list: • What 10 things should you do every day to improve your life?...

Read More

Government and Big Banks Joined Forces to Violently Crush Peaceful Protests: Mussolini Would Call It Fascism The definition of fascism...

Read More

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...

The Eurozone crisis transitioned from acute to chronic in 2012. Financial stabilization finally came after the year’s most...