“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...

“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...

Read More

My mother had a two-tone Maxima, light and dark blue. It replaced the five cylinder Audi which was a great car when it ran right, which...

Read More

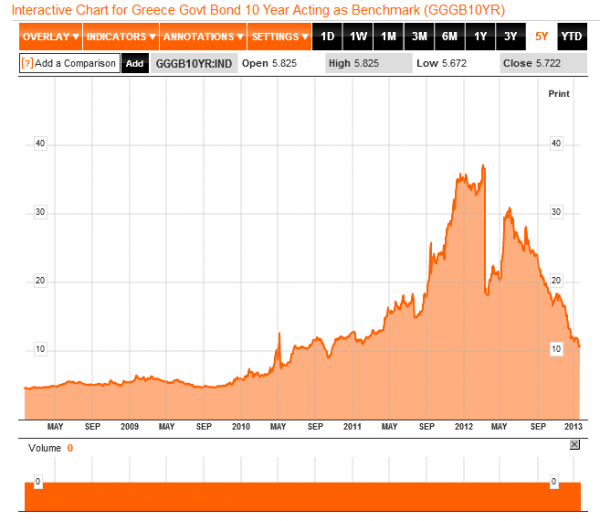

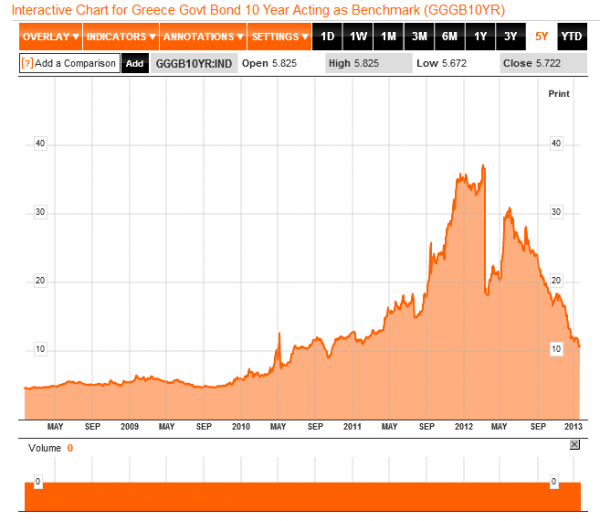

Prisoner of the Bureaucracy By John Mauldin January 25, 2013 Greece Must Stay in the Euro Beware of Greeks Bearing Bonds...

Prisoner of the Bureaucracy By John Mauldin January 25, 2013 Greece Must Stay in the Euro Beware of Greeks Bearing Bonds...

Read More

“Tough Year!” We hear that around the office nearly every day – from professional traders to money managers to even the...

Read More

Robert Shiller, a professor at Yale University and co-creator of the S&P/Case-Shiller index of property values, talks about the...

Read More

Ahhh, good to be back. Here are my long form pieces of journalism to start your snowy weekend: • Siri Rising: The Inside Story Of...

Ahhh, good to be back. Here are my long form pieces of journalism to start your snowy weekend: • Siri Rising: The Inside Story Of...

Read More

Flying home today, I recalled something someone sent me — a list of the funniest comedies of all time, with the number 1 flick . ....

Read More

How to create great slides for presentations from Mike Jeffs

Read More

“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...

“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...

“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...

“Americans seem to be falling in love with stocks again.” That is the first sentence of a front page NYTimes article,...