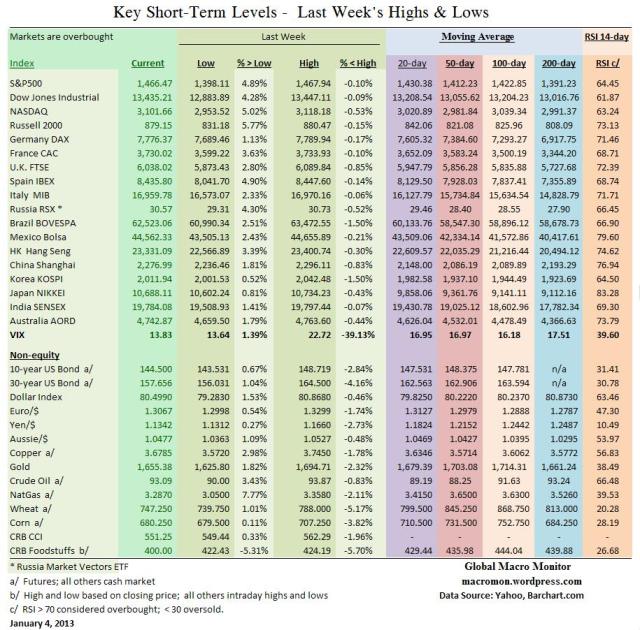

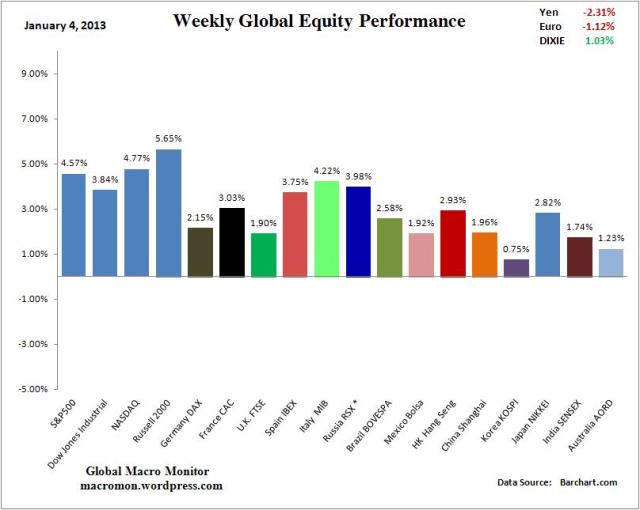

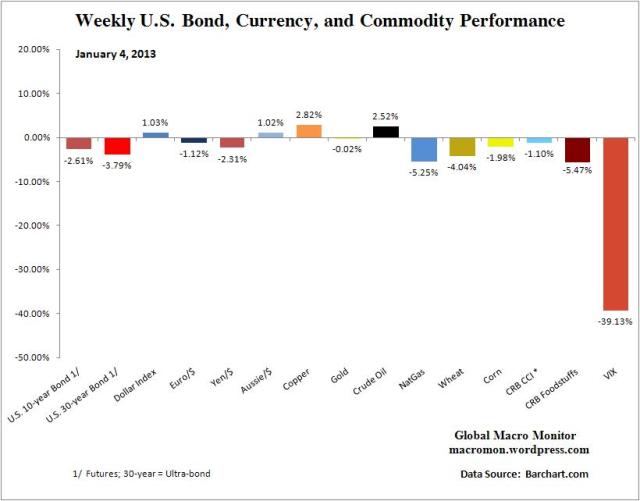

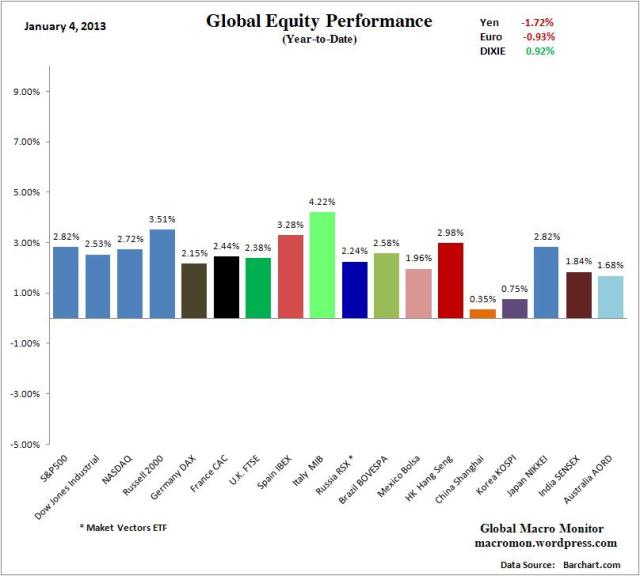

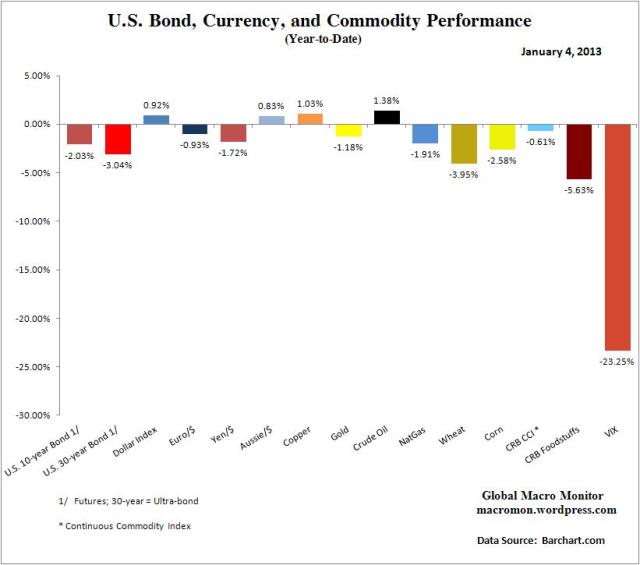

We’ve added Spain’s IBEX, Italy’s MIB, the Russia Market Vectors ETF, the Australian dollar to the list of equity indices and currencies we monitor. In addition, we have switched to the CRB Continuous Commodity Index, which is less energy heavy as all commodities receive an equal weighting.

~~~

(click here if charts are not observable)

What's been said:

Discussions found on the web: