My morning reads:

• Dow 14K 2nd time around (NYP) see also Lipper Fund Flows: Equity Mutual Fund Flows Hit Levels Unseen in Nearly 12 Years (Alpha Now)

• Suckers or saviors? Small investors buy up stocks (MarketWatch)

• Investors face end of big US bond returns (FT.com)

• Bernanke Voiced Alarm Over Credibility of Ratings Firms (Bloomberg) see also Controversial New Theory: S&P Got A Few Ratings Wrong (Dealbreaker)

• Confessions of a Corporate Spy (Inc)

• Platinum, Palladium Surge on Supply Concerns (WSJ)

• S&P Analyst Joked of Bringing Down the House Before Crash (Bloomberg) see also S.& P. E-Mails on Mortgage Crisis Show Alarm and Gallows Humor (DealBook)

• A Dose of Narcissism Can Be Useful (Scientific American)

• The NRA’s Enemies List (NRA-ILA)

• about.me goes independent (about.me)

What are you reading?

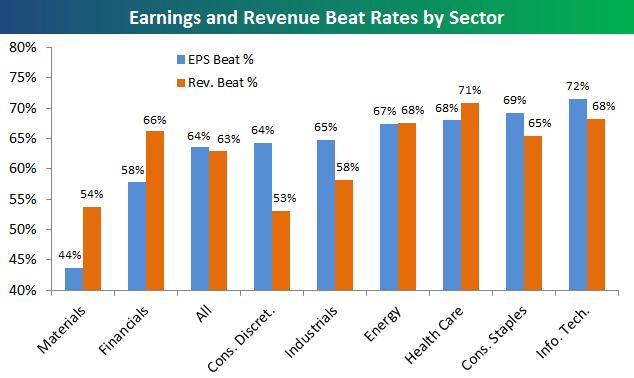

Earnings and Revenue Beat Rates by Sector

Source: Bespoke

What's been said:

Discussions found on the web: