My afternoon train reads:

• Establishing Your Top 10 Investment Default Settings (Above the Market)

• Top 5 cultural references Wall Streeters use when ripping people off (Fortune)

• Tight Credit Is Causing Housing Prices to Rise (Miller Samuel) Counter intuitive enough for you?

• Predicting Markets, or Marketing Predictions (Advisor Perspectives) see also Perils of Predictions (Inside Futures)

• So God made a banker (MarketWatch)

• Why History May Be Unkind to Tim Geithner (Real Clear Politics) see also Geithner, the under-appreciated finance guy (MarketWatch)

• The Tongue-Lashings of Chris Christie (Bloomberg)

• Understanding Apple Requires an Analysis of Fundamentals and Psychology (Institutional Investor)

• Venture Capital’s Massive, Terrible Idea For The Future Of College (The Awl)

• Dell Acquired By Gateway 2000 In Merger Of 2 Biggest Names In Computer Technology (The Onion)

What are you reading?

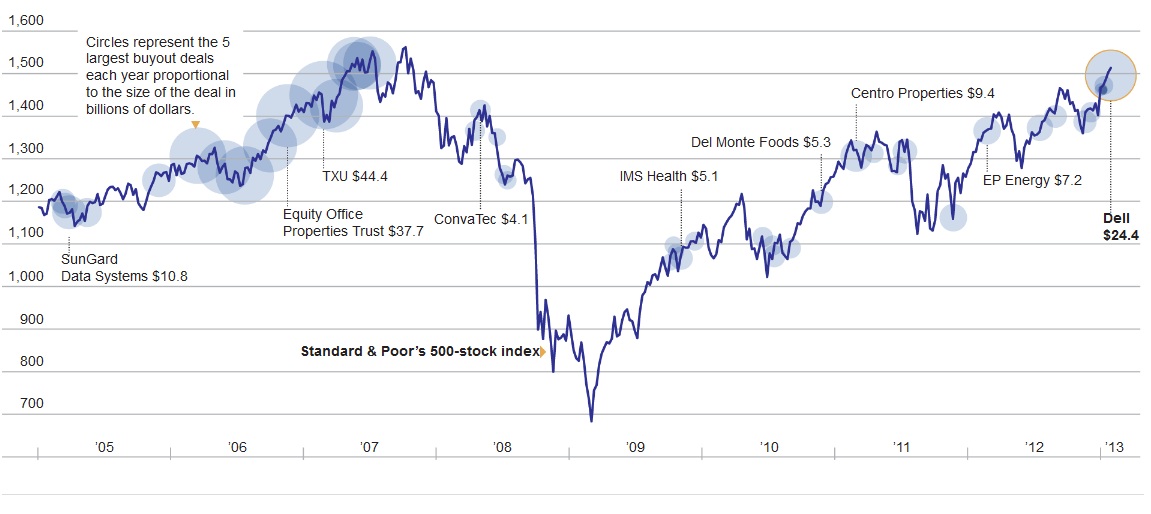

As Stocks Surge, Buyouts Return

Source: NYT

What's been said:

Discussions found on the web: