My afternoon train reading:

• Recovery Sign: More People Are Quitting Their Jobs (CNBC)

• Underwater Homes Remain a Dark Spot in the Recovery (The Fiscal Times) see also Pipe-Swipers Take Toilets as U.S. Homes With Plumbing Ebb (Bloomberg)

• Martin Wolf: The case for helicopter money (FT.com)

• Investors Use Bond ETFs to Sidestep Broken Fixed-Income Markets (Institutional Investor)

• Buffett’s Favorite Valuation Metric Surges Over the 100% Level (Pragmatic Capitalsim)

• Should the Fed pop bubbles by raising interest rates? (WonkBlog)

• The economics of 2033 (World Economic Forum)

• Can We Stabilize the Debt with Just $670 Billion in Deficit Reduction? (Next New Deal) see also Deficit-reduction disorder (The Economist)

• Island Hoping in the Galapagos (World Property Channel)

• Empire Military Errors: Inside the Battle of Hoth (Wired)

What are you reading?

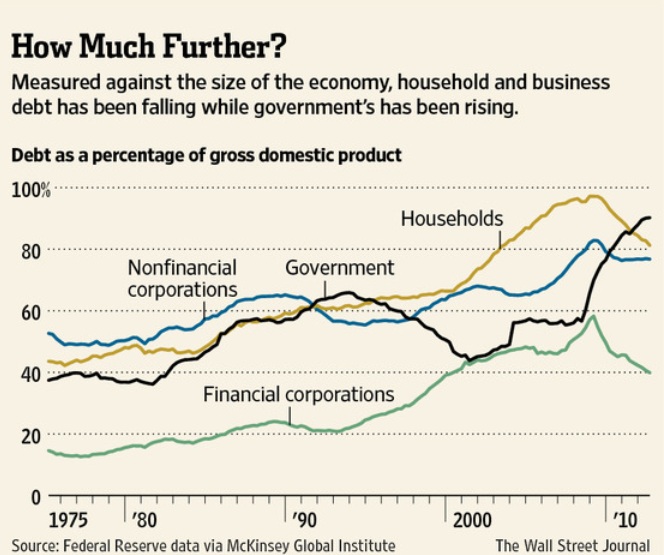

Borrowing: Key to Recession and Recovery

Source: WSJ

What's been said:

Discussions found on the web: