My afternoon train reads:

• Markets Saved by the Kid From South Carolina, Again (MarketBeat)

• The 40 Highest-Earning Hedge Fund Managers And Traders (Forbes) see also David Tepper Tops 2012 Hedge Fund Earnings (Forbes)

• Michael Mauboussin: Think Twice (Outlook Business)

• Lazy Portfolios at war with Wall Street casinos (MarketWatch) see also The (Really) High Price Of Active Management (The Capital Spectator)

• Why It’s Smart to Be Reckless on Wall Street (Scientific American)

• The Consequences of Sequestration (The Diplomat) see also Austerity Kills Government Jobs as Cuts to Budgets Loom (NYT)

• Gold Bugs Need to Replenish the Hive (MarketBeat)

• Apple Should Stay Prudent With Cash: Analyst (MarketBeat) see also Apple’s ‘Very Active’ Cash Talks Won’t Assuage Investors (Bloomberg)

• Deficit hawks’ ‘generational theft’ argument is a sham (Los Angeles Times)

• When Diet Meets Delicious (NYT)

What are you reading?

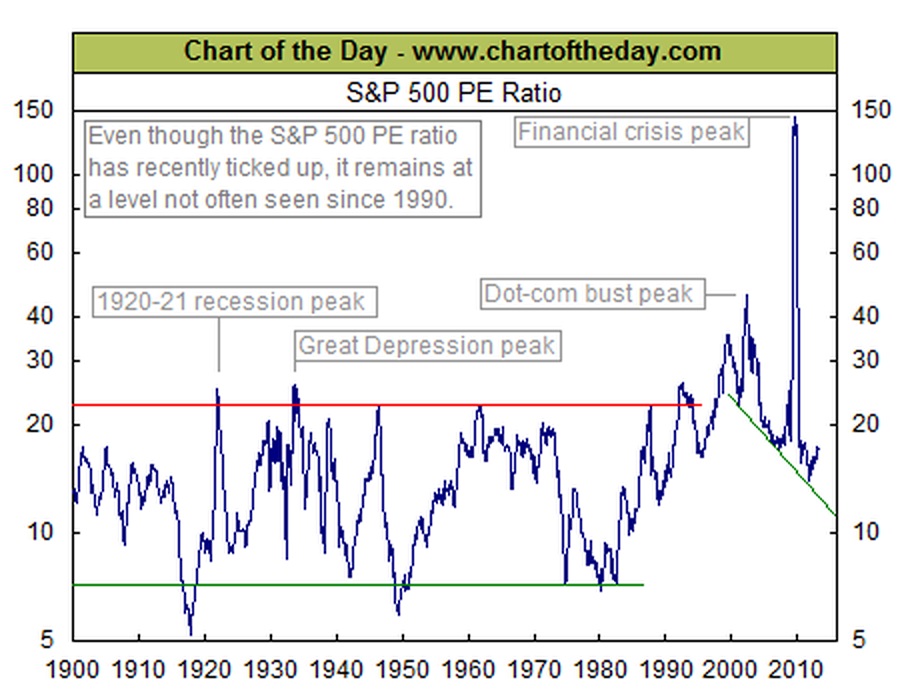

S&P500 PE Ratio

Source: Chart of the Day

What's been said:

Discussions found on the web: