Good Sunday morning, some reads to finish up your weekend:

• Jeremy Grantham: Investing in a Low-Growth World (Barron’s)

• Ego and ambition lie behind Dell buyout (FT.com)

• Florida Is Swamped with Foreclosures – And Deals on Distressed Homes (TIME)

• NYTimes Rating Agencies Two-fer:

…..-In Actions, S.&P. Risked Andersen’s Fate (NYT)

…..-On the Waiting List at the Debt-Rating Club (NYT)

• What Good Do Money Management Firms Have to Offer? (PBS Newshour)

• Mary Jo White’s Past and the Future of the SEC (Bloomberg) see also Who Says Tim Geithner Isn’t Getting a Big Payoff From Wall Street Pals (Wall Street on Parade)

• U.K. LESSON: AUSTERITY LEADS TO MORE DEBT (New Yorker)

• Renewable energy now cheaper than new fossil fuels in Australia (Bloomberg Brief) see also Marco Rubio: Another Senator Who Doubts Global Warming (Slate)

• Flickr Is Back, Letting Us Go Home Again (Wired)

• 5 Things You Didn’t Know About Miami Vice (Classic Driver)

What’s for Brunch ?

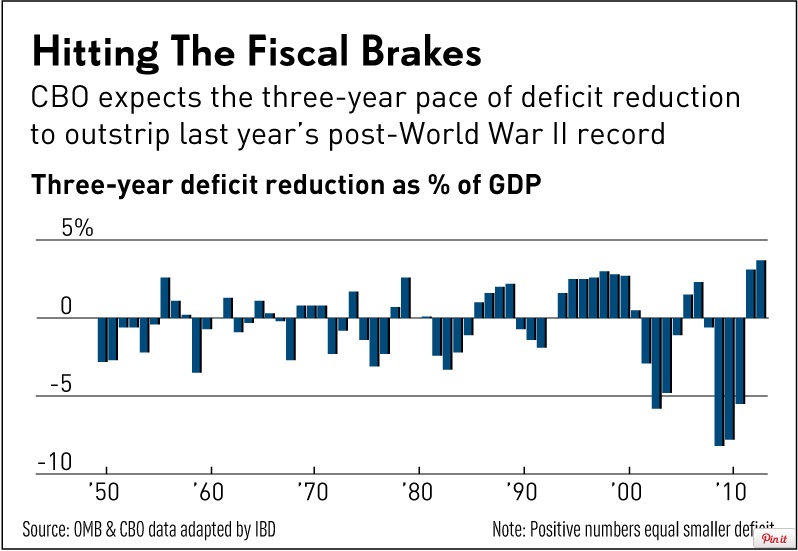

Deficit Shrinking At Fastest Pace Since WWII As GDP Sputters

Source: Investors.com

What's been said:

Discussions found on the web: