My morning reads:

• The Next Secular Bull Market Is Still A Few Years Away (Street Talk Live) see also Insiders now aggressively bearish (MarketWatch)

• The bullshit about uncertainty: How a Nation Got Snookered by a Phony Narrative (Bloomberg)

• Federal Reserve Hit by Hackers (PCMAG)

• Money Changes Everything (NYT)

• Time for Tiny Fees on HFT: The .03% Solution (ProPublica) or Revive the Financial Transaction Tax (DealBook)

• RBS: “Just amazing how libor fixing can make you so much money” (FT Alphaville)

• Burning Down the House of S&P (Rational Irrationality) see also State Lawsuits Could Add to S&P Exposure (WSJ)

• EVERYBODY HATES BONDS: Jim Rogers Joins Bill Gross Warning on Treasuries (Bloomberg)

• Is Facebook over? (Salon) see also Twitter on Route to Maturity—Maybe IPO (WSJ)

• ‘Bailout’: Neil Barofsky’s Adventures in Groupthink City (TAIBBLOG)

What are you reading?

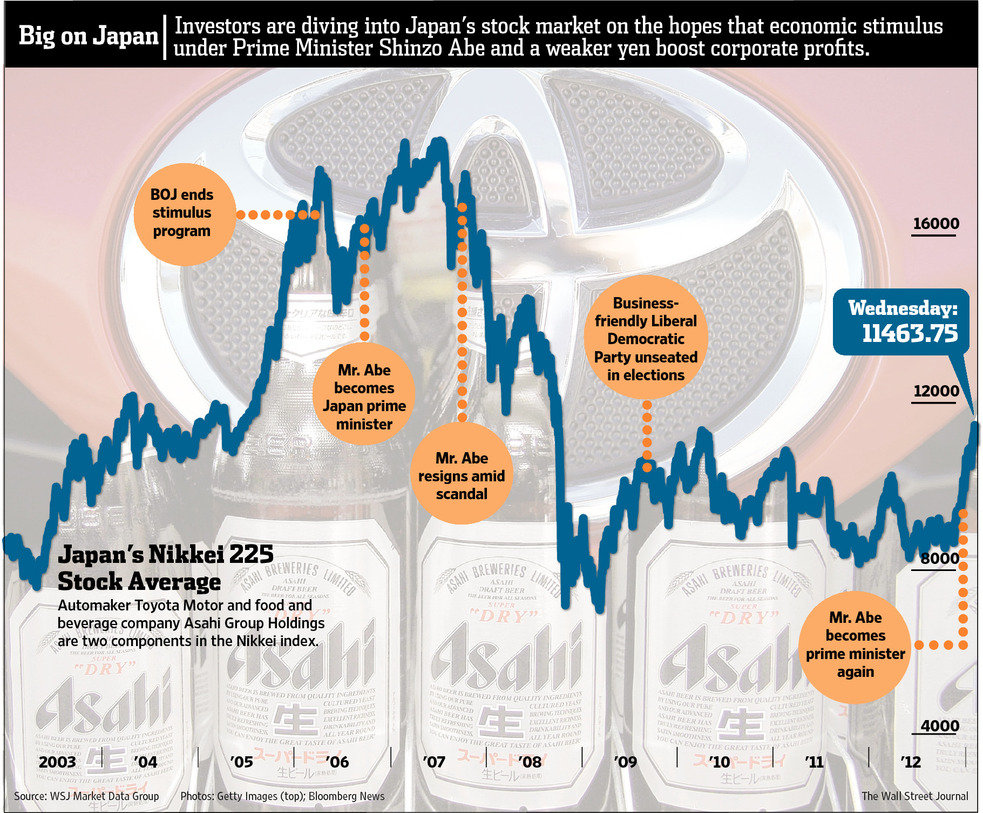

Shades of ’80s for Japan’s Stocks

Source: WSJ

What's been said:

Discussions found on the web: