My afternoon train reading:

• Your Brain in Love (Scientific American)

• Big Wall Street Buyouts Might Be a Bullish Sign (The Slant)

• Less-Trusting Millennial Investors Pose Challenge to Advisors (Advisor One)

• The Biggest Financial Asset in Your Portfolio Is You (NYT)

• Why Inflation Doves Are Really Hawks (Employment, Interest, and Money)

• Housing as an Investment? Yes, That Idea Is Back (Businessweek)

• Backdated Mortgage Assignment Comes Back To Haunt Foreclosure Lender in Juarez v. Select Portfolio (The Massachusetts Real Estate Blog )

• The Seven Habits of Highly Effective Mediocre People (The Rumpus)

• Want to Dump Your Bank? Now There Is an App for That (WSJ)

• The Brilliance of the Dog Mind (Scientific American)

What are you reading?

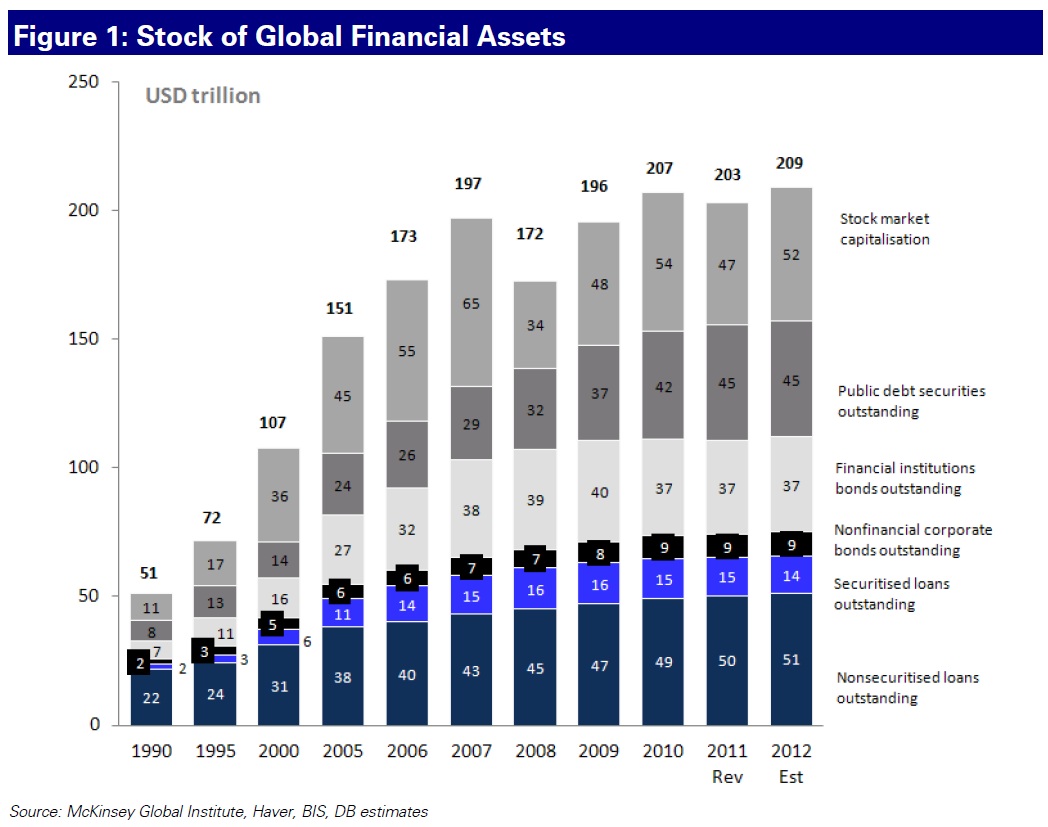

Global financial assets

Source: Deutsche Bank via FT.com

What's been said:

Discussions found on the web: