My afternoon train reading:

• How to know when it’s time to leave the party (MarketWatch) but see Moving Averages: Month-End Update (Advisor Perspectives)

• Paulson Leads Funds to Bermuda Tax Dodge Aiding Billionaires (Bloomberg)

• Confessions of a Barclays Banker Who’s Seen the Light (The Fiscal Times)

• The Modern Stealth Depression (minyanville) versus This Rally Is in Its Infancy (Yahoo Finance)

• Why doesn’t anybody (other than Samsung) copy Apple? (ASYMCO)

• The Rise of the Robots (Project-Syndicate) see also No College Diploma, No Job, Even as a File Clerk (NYT)

• Under The Radar – The World Of A Stealth Aircraft (LurnQ)

• How To Create a Mind: Can a marriage between man and machine solve the world’s problems? (The Globe and Mail) but see The Brain is Not Computable (MIT Review of Books)

• The Agony Of The Fanboy (techcrunch)

• 50 Years Ago: The World in 1963 (The Atlantic)

What are you reading?

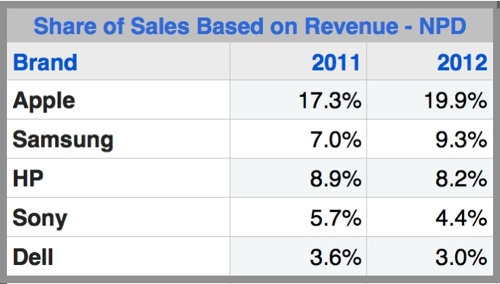

Apple accounts for 20% of all 2012 US consumer technology sales revenue

Source: Apple Insider

What's been said:

Discussions found on the web: