My afternoon train reads:

• Naive Speculators Were Hit Hard (Price Action Lab)

• Bankers are honorable men (MarketWatch) see also Remember That $83 Billion Bank Subsidy? We Weren’t Kidding (The Ticker)

• First U.S. Bank Regulations May Look Strikingly Familiar (Echoes)

• Financial Media Wakeup Call: The Big Disconnect (The Reformed Broker)

• Wage gaps destroy employee morale, productivity (Financial Post) see also The Political Importance of Elizabeth Warren (Project Syndicate)

• Apple CEO to Face Investors Seeking More of Cash Hoard (Bloomberg)

• What Our Brains Can Teach Us (NYT)

• Science and gun violence: Why is the research so weak? (boing boing)

• What “Disrupt” Really Means (Tech Crunch)

• Wonderful, Glorious Eel (EELS)

What are you reading?

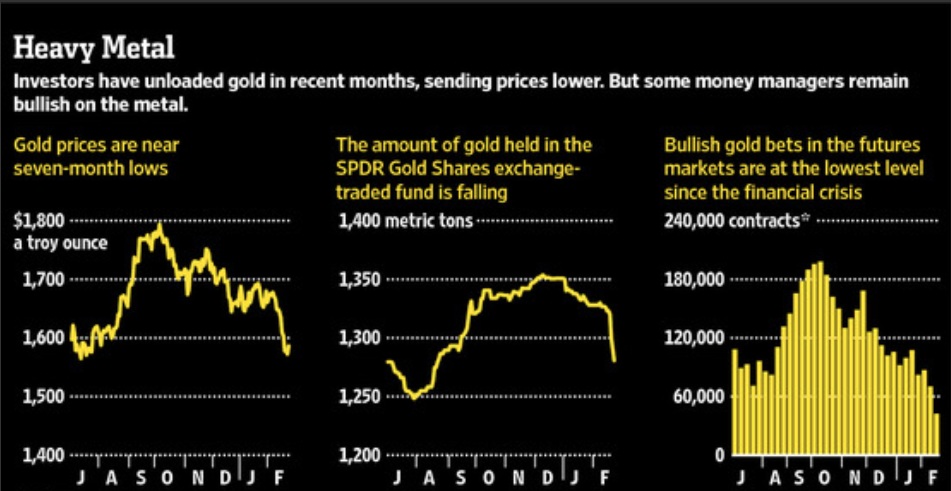

Big Investors Differ on Gold’s Prospects

Source: WSJ

What's been said:

Discussions found on the web: